Question: continue in the future. However, we can use growth rates as projected by security analysts, who regularly forecast growth rates of earnings and dividends. is

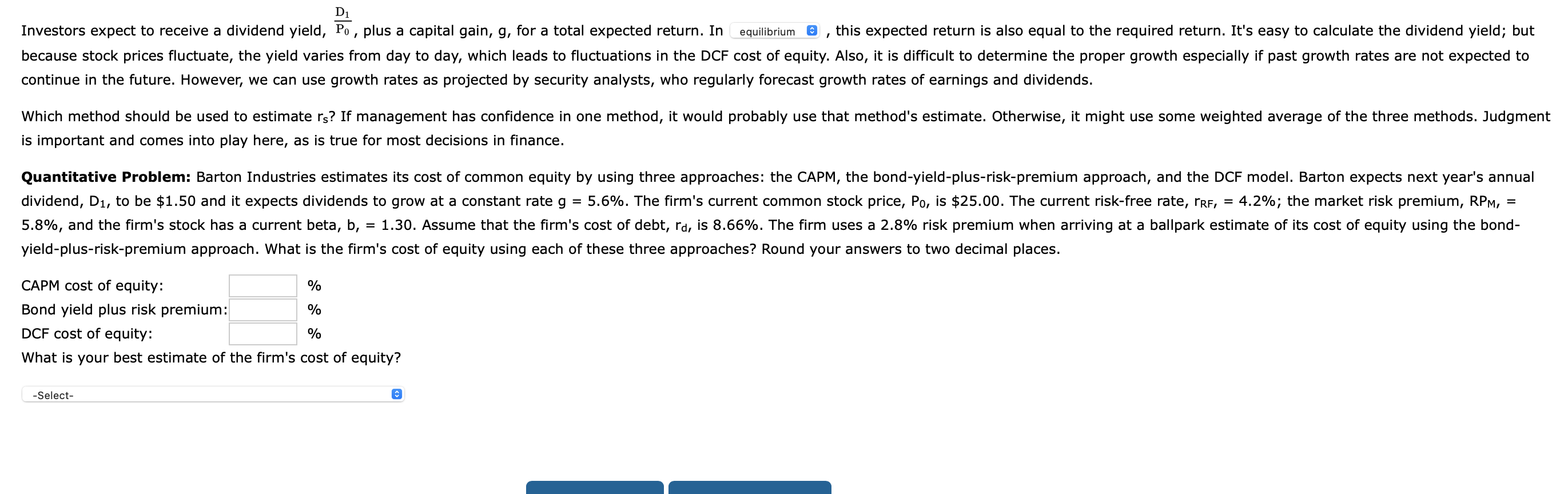

continue in the future. However, we can use growth rates as projected by security analysts, who regularly forecast growth rates of earnings and dividends. is important and comes into play here, as is true for most decisions in finance. yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: Bond yield plus risk premium: DCF cost of equity: % % % What is your best estimate of the firm's cost of equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock