Question: Continue with the information provided in the Question above. If you believe that the actual 3-year interest rate, two years from now, will be 5.0%,

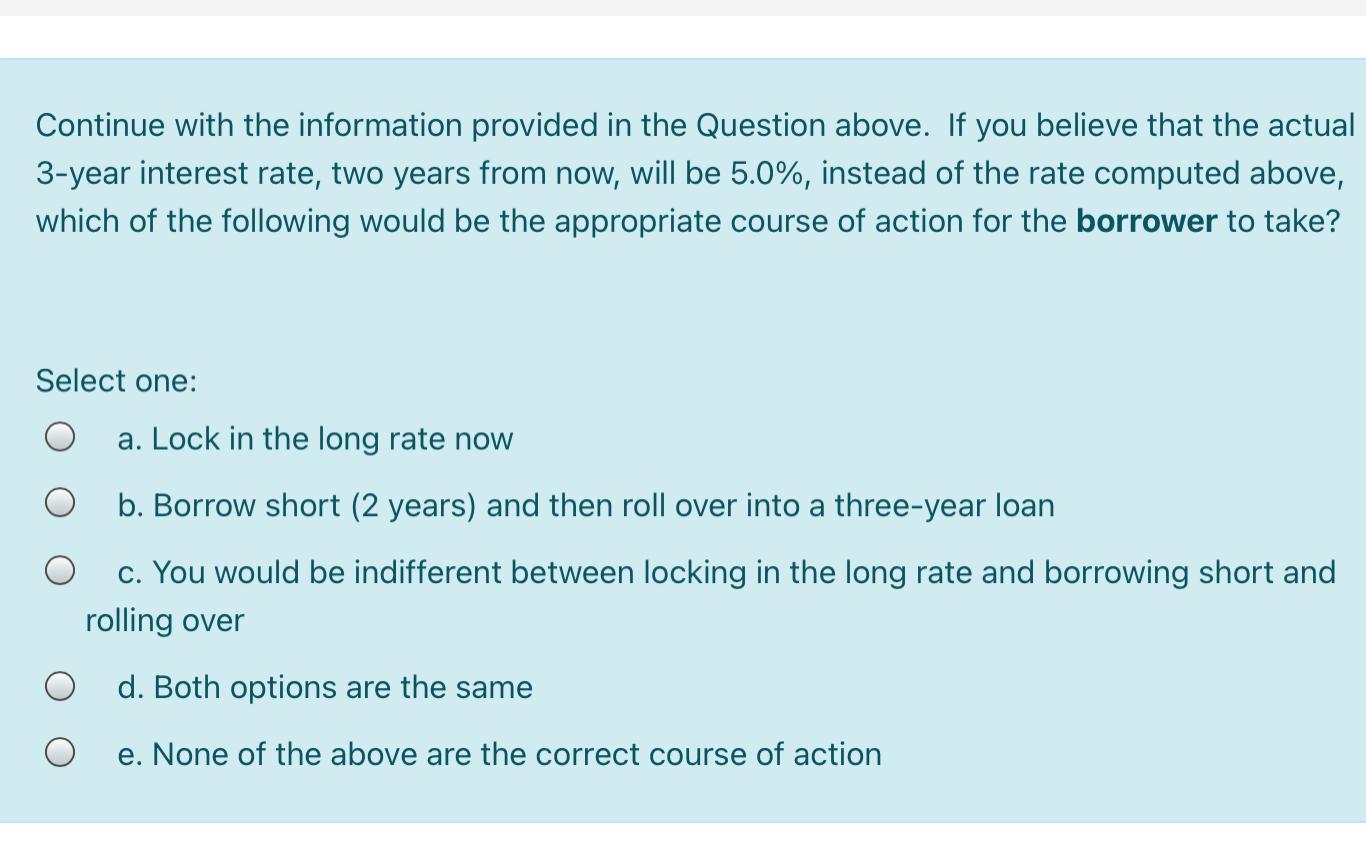

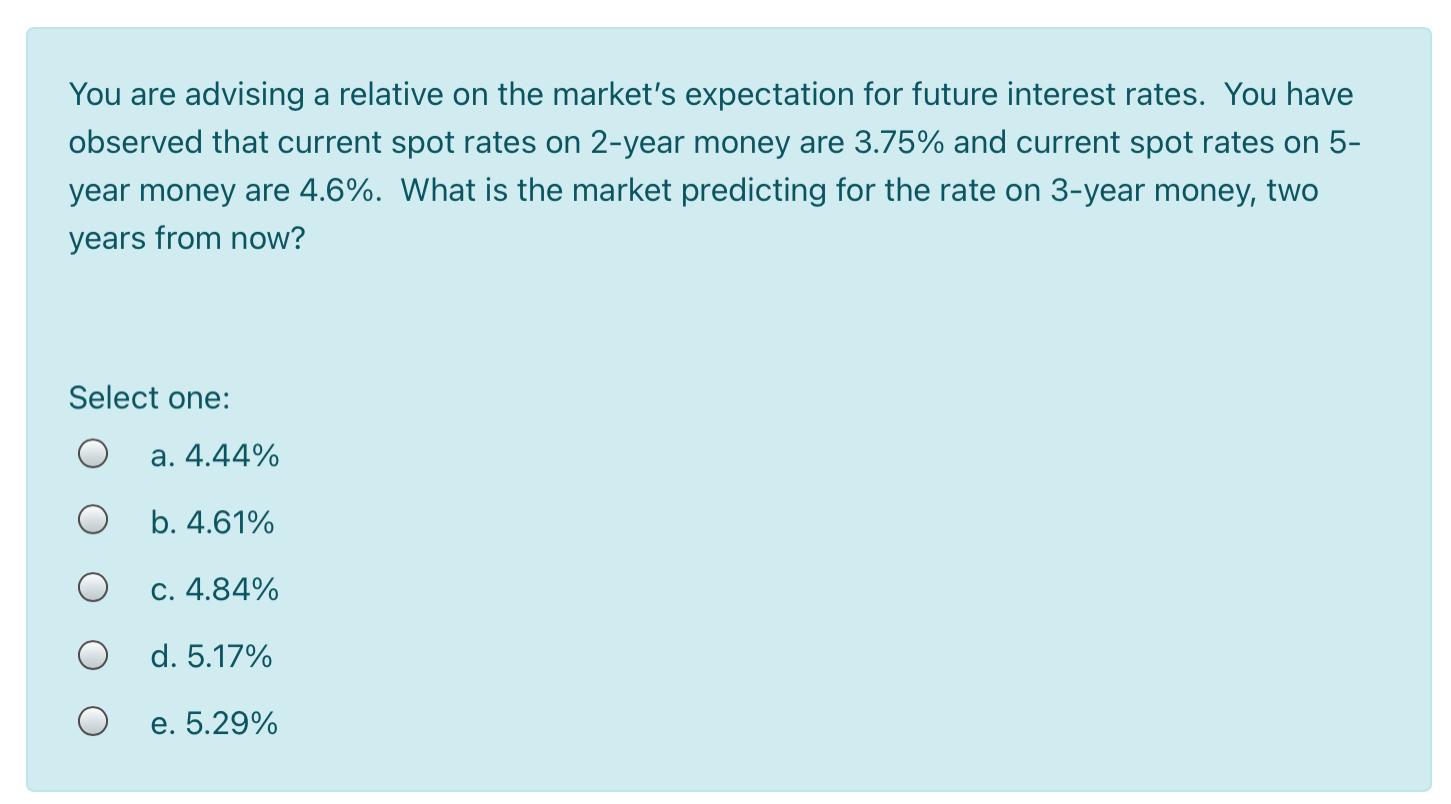

Continue with the information provided in the Question above. If you believe that the actual 3-year interest rate, two years from now, will be 5.0%, instead of the rate computed above, which of the following would be the appropriate course of action for the borrower to take? Select one: a. Lock in the long rate now b. Borrow short (2 years) and then roll over into a three-year loan c. You would be indifferent between locking in the long rate and borrowing short and rolling over d. Both options are the same e. None of the above are the correct course of action You are advising a relative on the market's expectation for future interest rates. You have observed that current spot rates on 2-year money are 3.75% and current spot rates on 5- year money are 4.6%. What is the market predicting for the rate on 3-year money, two years from now? Select one: O a. 4.44% b. 4.61% C. 4.84% d. 5.17% e. 5.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts