Question: Continue with the same $10,000, 3-year, 6% note. This time, assume that the loan started on October 1, 2022. Prepare the journal entries as indicated.

Continue with the same $10,000, 3-year, 6% note. This time, assume that the loan started on October 1, 2022. Prepare the journal entries as indicated. The note will be repaid on October 1, 2025.

| Date | Account | Debit | Credit |

|

| Entry for borrowing |

|

|

| 10/1/22 |

|

|

|

|

|

|

|

|

|

| Adjusting entry for 2022 interest |

|

|

| 12/31/22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusting entry for 2023 interest |

|

|

| 12/31/23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusting entry for 2024 interest |

|

|

| 12/31/24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayment entry for 10/1/25 |

|

|

| 10/1/25 |

|

|

|

|

|

|

|

|

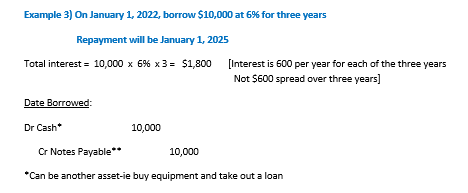

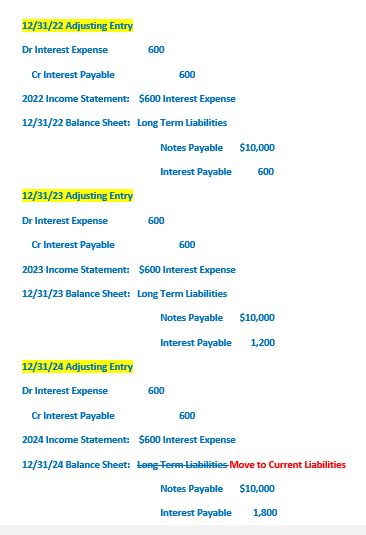

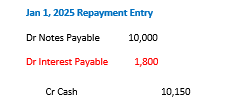

Example 3) On January 1, 2022, borrow $10,000 at 6% for three years Repayment will be January 1, 2025 Total interest =10,0006%3=$1,800 [Interest is 600 per year for each of the three years Not $600 spread over three years] Date Borrowed: Dr Cash* 10,000 Cr Notes Payable* 10,000 "Can be another asset-ie buy equipment and take out a loan 12/31/22 Adjusting Entry Dr Interest Expense 600 Cr Interest Payable 600 2022 Income Statement: $600 Interest Expense 12/31/22 Balance Sheet: Long Term Liabilities Notes Payable $10,000 Interest Payable 600 12/31/23 Adjusting Entry Dr Interest Expense 600 Cr Interest Payable 600 2023 Income Statement: $600 Interest Expense 12/31/23 Balance Sheet: Long Term Liabilities Notes Payable $10,000 Interest Payable 1,200 12/31/24 Adjusting Entry Dr lnterest Expense 600 Cr Interest Payable 600 2024 Income Statement: $600 Interest Expense 12/31/24 Balance Sheet: Leng Tefm Liabilities Move to Current Liabilities Notes Payable $10,000 Interest Payable 1,800 Jan 1, 2025 Repayment Entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts