Question: Continue with the same assumptions for the No Change scenario from the previous question, but now forecast the balance sheet and income statements for 2020

- Continue with the same assumptions for the No Change scenario from the previous question, but now forecast the balance sheet and income statements for 2020 (but not for the following 3 years) using the following preliminary financial policy. (1) Regular dividends will grow by 10%. (2) No additional long-term debt or common stock will be issued. (3) The interest rate on all debt is 8%. (4) Interest expense for long-term debt is based on the average balance during the year. (5) If the operating results and the preliminary financing plan cause a financing deficit, eliminate the deficit by drawing on a line of credit. The line of credit would be tapped on the last day of the year, so it would create no additional interest expenses for that year. (6) If there is a financing surplus, eliminate it by paying a special dividend. After forecasting the 2020 financial statements, answer the following questions.

- (1) How much will Hatfield need to draw on the line of credit?

- (2) What are some alternative ways than those in the preliminary financial policy that Hatfield might choose to eliminate the financing deficit?

- Repeat the analysis performed in the previous question, but now assume that Hatfield is able to improve the following inputs: (1) Reduce operating costs (excluding depreciation) to sales to 89.4% at a cost of $40 million. (2) Reduce inventories/sales to 14% at a cost of $10 million. (3) Reduce net fixed assets/sales to 38% at a cost of $20 million. This is the Improve scenario.

- (1) Should Hatfield implement the improvement plan? How much value would it add to the company?

- (2) How much can Hatfield pay as a special dividend in the Improve scenario? What else might Hatfield do with the financing surplus

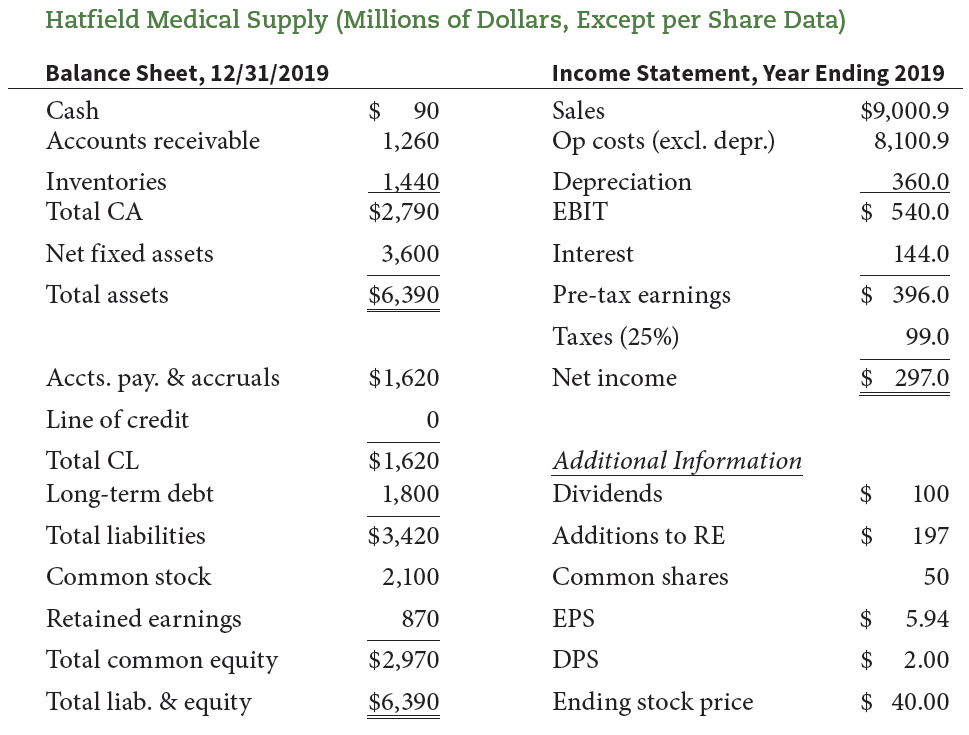

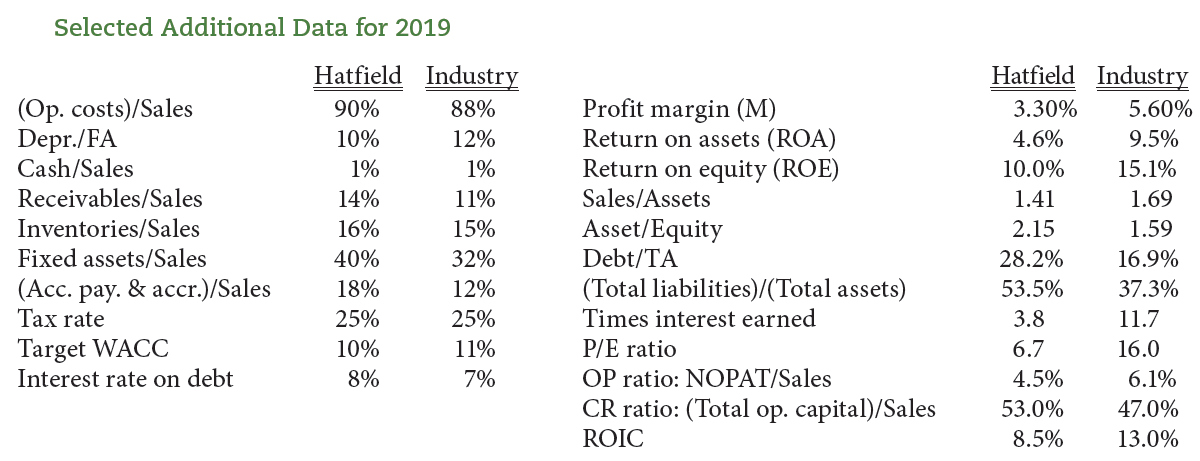

Hatfield Medical Supply (Millions of Dollars, Except per Share Data) Balance Sheet, 12/31/2019 Cash Accounts receivable $ 90 1,260 Income Statement, Year Ending 2019 Sales $9,000.9 Op costs (excl. depr.) 8,100.9 Depreciation 360.0 EBIT $ 540.0 Inventories Total CA 1,440 $2,790 Net fixed assets 3,600 Interest 144.0 Total assets $6,390 $ 396.0 Pre-tax earnings Taxes (25%) Net income 99.0 $1,620 $ 297.0 0 Accts. pay. & accruals Line of credit Total CL Long-term debt Total liabilities $1,620 1,800 Additional Information Dividends $ 100 $3,420 Additions to RE $ 197 Common stock 2,100 Common shares 50 870 EPS $ 5.94 Retained earnings Total common equity Total liab. & equity $2,970 DPS $ 2.00 $6,390 Ending stock price $ 40.00 Selected Additional Data for 2019 (Op. costs)/Sales Depr./FA Cash/Sales Receivables/Sales Inventories/Sales Fixed assets/Sales (Acc. pay. & accr.)/Sales Tax rate Target WACC Interest rate on debt Hatfield Industry 90% 88% 10% 12% 1% 1% 14% 11% 16% 15% 40% 32% 18% 12% 25% 25% 10% 11% 8% 7% Profit margin (M) Return on assets (ROA) Return on equity (ROE) Sales/Assets Asset/Equity Debt/TA (Total liabilities)/(Total assets) Times interest earned P/E ratio OP ratio: NOPAT/Sales CR ratio: (Total op. capital)/Sales ROIC Hatfield Industry 3.30% 5.60% 4.6% 9.5% 10.0% 15.1% 1.41 1.69 2.15 1.59 28.2% 16.9% 53.5% 37.3% 3.8 11.7 6.7 16.0 4.5% 6.1% 53.0% 47.0% 8.5% 13.0% Hatfield Medical Supply (Millions of Dollars, Except per Share Data) Balance Sheet, 12/31/2019 Cash Accounts receivable $ 90 1,260 Income Statement, Year Ending 2019 Sales $9,000.9 Op costs (excl. depr.) 8,100.9 Depreciation 360.0 EBIT $ 540.0 Inventories Total CA 1,440 $2,790 Net fixed assets 3,600 Interest 144.0 Total assets $6,390 $ 396.0 Pre-tax earnings Taxes (25%) Net income 99.0 $1,620 $ 297.0 0 Accts. pay. & accruals Line of credit Total CL Long-term debt Total liabilities $1,620 1,800 Additional Information Dividends $ 100 $3,420 Additions to RE $ 197 Common stock 2,100 Common shares 50 870 EPS $ 5.94 Retained earnings Total common equity Total liab. & equity $2,970 DPS $ 2.00 $6,390 Ending stock price $ 40.00 Selected Additional Data for 2019 (Op. costs)/Sales Depr./FA Cash/Sales Receivables/Sales Inventories/Sales Fixed assets/Sales (Acc. pay. & accr.)/Sales Tax rate Target WACC Interest rate on debt Hatfield Industry 90% 88% 10% 12% 1% 1% 14% 11% 16% 15% 40% 32% 18% 12% 25% 25% 10% 11% 8% 7% Profit margin (M) Return on assets (ROA) Return on equity (ROE) Sales/Assets Asset/Equity Debt/TA (Total liabilities)/(Total assets) Times interest earned P/E ratio OP ratio: NOPAT/Sales CR ratio: (Total op. capital)/Sales ROIC Hatfield Industry 3.30% 5.60% 4.6% 9.5% 10.0% 15.1% 1.41 1.69 2.15 1.59 28.2% 16.9% 53.5% 37.3% 3.8 11.7 6.7 16.0 4.5% 6.1% 53.0% 47.0% 8.5% 13.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts