Question: Continue working on your original worksheet and add the adjustments below to your worksheet. Be sure to also write the journal entries for the adjustments

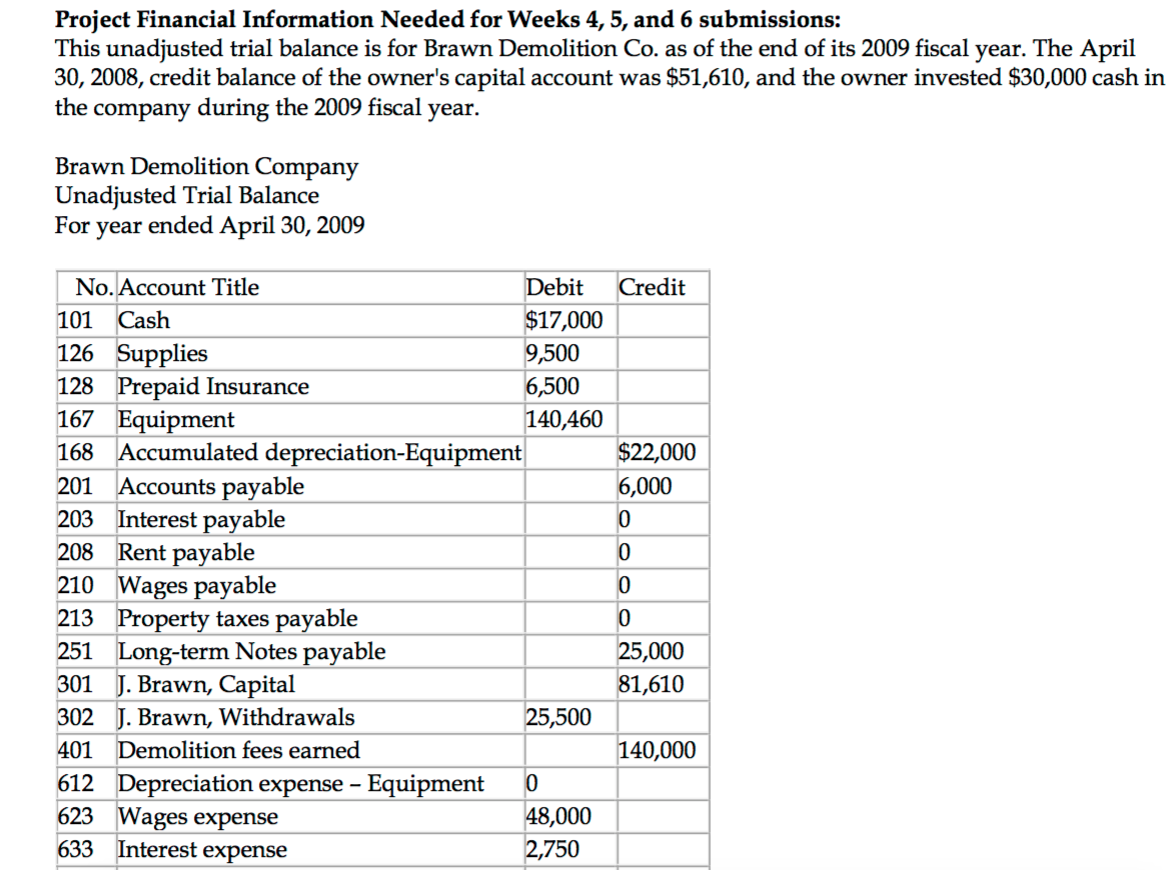

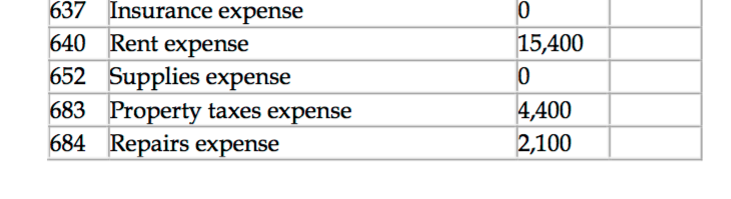

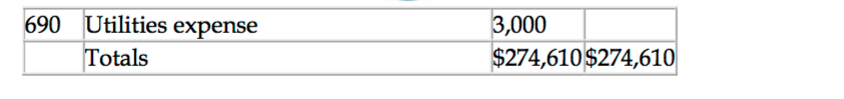

Continue working on your original worksheet and add the adjustments below to your worksheet. Be sure to also write the journal entries for the adjustments in proper format below the worksheet or on a second page of your workbook. Remember we covered adjusting journal entries in Chapter 3 of your text. Dont forget to total your columns, again they should be equal. Here are the adjustments to be made: a) The supplies available at the end of fiscal year 2009 had a cost of $3,420. b) The cost of expired insurance for the fiscal year is $4,095. c) Annual depreciation on equipment is $11,000. d) The April utilities expense of $580 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $580 amount owed needs to be recorded. e) The company's employees have earned $1,500 of accrued wages at fiscal year-end. f) The rent expense incurred and not yet paid or recorded at fiscal year-end is $1,400. g) Additional property taxes of $500 have been assessed but have not been paid or recorded in the accounts. h) The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the 2009 fiscal year. The $250 accrued interest for April has not yet been paid or recorded. (Note that the company is required to make a $5,000 payment toward the note payable during the 2010 fiscal year.) Now you need to combine the columns in the unadjusted trial balance with those in the adjustments columns to obtain the figures for the adjusted trial balance. Remember for accounts that have a normal debit balance, you add debits to debits, and you subtract credits from debits. If the account has a normal credit balance, you add credits to credits and subtract debits from credits. It is very important to pay attention to the normal balance of each account. Again, total both columns and they should balance.

Continue working on your original worksheet and add the adjustments below to your worksheet. Be sure to also write the journal entries for the adjustments in proper format below the worksheet or on a second page of your workbook. Remember we covered adjusting journal entries in Chapter 3 of your text. Dont forget to total your columns, again they should be equal. Here are the adjustments to be made: a) The supplies available at the end of fiscal year 2009 had a cost of $3,420. b) The cost of expired insurance for the fiscal year is $4,095. c) Annual depreciation on equipment is $11,000. d) The April utilities expense of $580 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $580 amount owed needs to be recorded. e) The company's employees have earned $1,500 of accrued wages at fiscal year-end. f) The rent expense incurred and not yet paid or recorded at fiscal year-end is $1,400. g) Additional property taxes of $500 have been assessed but have not been paid or recorded in the accounts. h) The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the 2009 fiscal year. The $250 accrued interest for April has not yet been paid or recorded. (Note that the company is required to make a $5,000 payment toward the note payable during the 2010 fiscal year.) Now you need to combine the columns in the unadjusted trial balance with those in the adjustments columns to obtain the figures for the adjusted trial balance. Remember for accounts that have a normal debit balance, you add debits to debits, and you subtract credits from debits. If the account has a normal credit balance, you add credits to credits and subtract debits from credits. It is very important to pay attention to the normal balance of each account. Again, total both columns and they should balance.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts