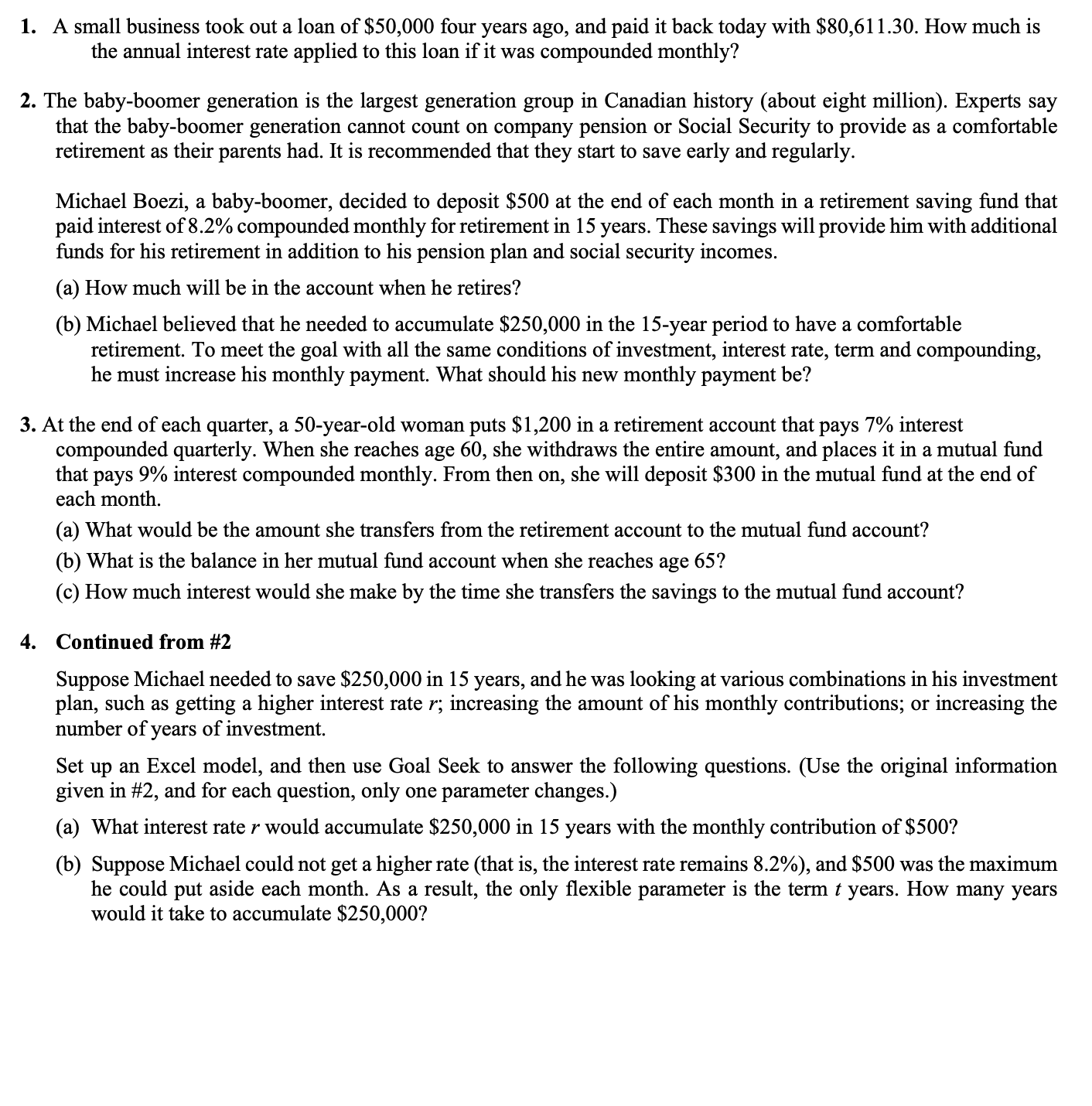

Question: Continued from #2 Suppose Michael needed to save $250,000 in 15 years, and he was looking at various combinations in his investment plan, such as

Continued from #2

Suppose Michael needed to save $250,000 in 15 years, and he was looking at various combinations in his investment plan, such as getting a higher interest rate r; increasing the amount of his monthly contributions; or increasing the number of years of investment.

Set up an Excel model, and then use Goal Seek to answer the following questions. (Use the original information given in #2, and for each question, only one parameter changes.)

(a) What interest rate r would accumulate $250,000 in 15 years with the monthly contribution of $500?

(b) Suppose Michael could not get a higher rate (that is, the interest rate remains 8.2%), and $500 was the maximum he could put aside each month. As a result, the only flexible parameter is the term t years. How many years would it take to accumulate $250,000?

1. A small business took out a loan of $50,000 four years ago, and paid it back today with $80,61130. How much is the annual interest rate applied to this loan if it was compounded monthly? 2. The baby-boomer generation is the largest generation group in Canadian history (about eight million). Experts say that the baby-boomer generation cannot count on company pension or Social Security to provide as a comfortable retirement as their parents had. It is recommended that they start to save early and regularly. Michael Boezi, a baby-boomer, decided to deposit $500 at the end of each month in a retirement saving fund that paid interest of 8.2% compounded monthly for retirement in 15 years. These savings will provide him with additional funds for his retirement in addition to his pension plan and social security incomes. (a) How much will be in the account when he retires? (b) Michael believed that he needed to accumulate $250,000 in the 15-year period to have a comfortable retirement. To meet the goal with all the same conditions of investment, interest rate, term and compounding, he must increase his monthly payment. What should his new monthly payment be? 3. At the end of each quarter, a 50-year-old woman puts $1,200 in a retirement account that pays 7% interest compounded quarterly. When she reaches age 60, she withdraws the entire amount, and places it in a mutual fund that pays 9% interest compounded monthly. From then on, she will deposit $300 in the mutual fund at the end of each month. (a) What would be the amount she transfers from the retirement account to the mutual fund account? (b) What is the balance in her mutual fund account when she reaches age 65 ? (c) How much interest would she make by the time she transfers the savings to the mutual fund account? 4. Continued from \#2 Suppose Michael needed to save $250,000 in 15 years, and he was looking at various combinations in his investment plan, such as getting a higher interest rate r; increasing the amount of his monthly contributions; or increasing the number of years of investment. Set up an Excel model, and then use Goal Seek to answer the following questions. (Use the original information given in \#2, and for each question, only one parameter changes.) (a) What interest rate r would accumulate $250,000 in 15 years with the monthly contribution of $500 ? (b) Suppose Michael could not get a higher rate (that is, the interest rate remains 8.2% ), and $500 was the maximum he could put aside each month. As a result, the only flexible parameter is the term t years. How many years would it take to accumulate $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts