Question: Continued from previous question Assume the yield curve is flat and the T-bill rate is 5%. The market return is 10% Portfolio XY has a

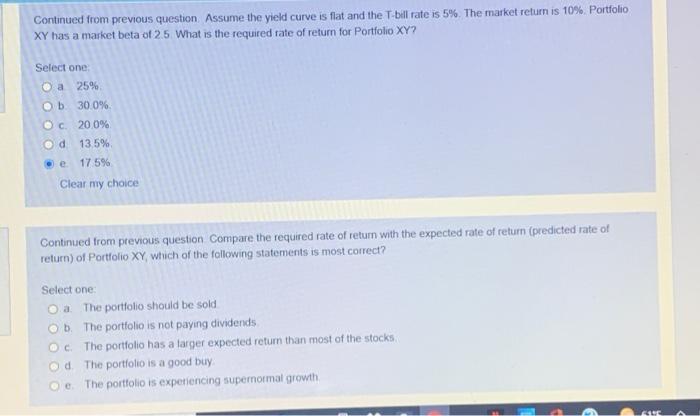

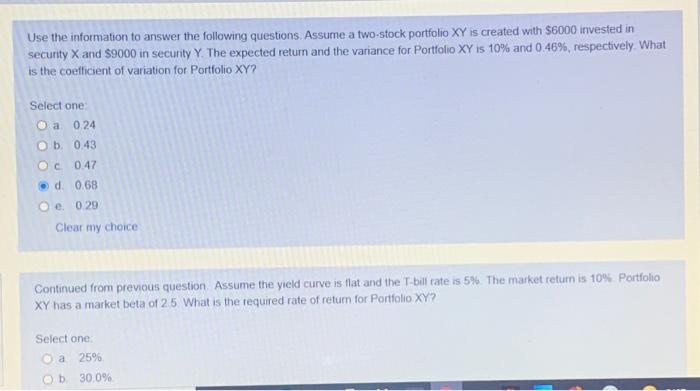

Continued from previous question Assume the yield curve is flat and the T-bill rate is 5%. The market return is 10% Portfolio XY has a market beta of 2.5 What is the required rate of return for Portfolio XY? Select one a 25% Ob 30.0% OC 20.0% od 13.5% e 17 5% Clear my choice Continued from previous question Compare the required rate of return with the expected rate of return (predicted rate of return) of Portfolio XYwhich of the following statements is most correct? Select one O a The portfolio should be sold Ob. The portfolio is not paying dividends Oc. The portfolio has a larger expected return than most of the stocks Od. The portfolio is a good buy we The portfolio is experiencing supernormal growth ELEE A Use the information to answer the following questions. Assume a two-stock portfolio XY is created with $6000 invested in security X and $9000 in security Y. The expected return and the variance for Portfolio XY is 10% and 0.46%, respectively What is the coefficient of variation for Portfolio XY? Select one @ a 0.24 O b0.43 @c0.47 d 0.68 Oe. 029 Clear my choice Continued from previous question. Assume the yield curve is flat and the T-bill rate is 5% The market return is 10%. Portfolio XY has a market beta of 2.5 What is the required rate of retum for Portfolio XY? Select one a 25% Ob 30.0% Continued from previous question Assume the yield curve is flat and the T-bill rate is 5%. The market return is 10% Portfolio XY has a market beta of 2.5 What is the required rate of return for Portfolio XY? Select one a 25% Ob 30.0% OC 20.0% od 13.5% e 17 5% Clear my choice Continued from previous question Compare the required rate of return with the expected rate of return (predicted rate of return) of Portfolio XYwhich of the following statements is most correct? Select one O a The portfolio should be sold Ob. The portfolio is not paying dividends Oc. The portfolio has a larger expected return than most of the stocks Od. The portfolio is a good buy we The portfolio is experiencing supernormal growth ELEE A Use the information to answer the following questions. Assume a two-stock portfolio XY is created with $6000 invested in security X and $9000 in security Y. The expected return and the variance for Portfolio XY is 10% and 0.46%, respectively What is the coefficient of variation for Portfolio XY? Select one @ a 0.24 O b0.43 @c0.47 d 0.68 Oe. 029 Clear my choice Continued from previous question. Assume the yield curve is flat and the T-bill rate is 5% The market return is 10%. Portfolio XY has a market beta of 2.5 What is the required rate of retum for Portfolio XY? Select one a 25% Ob 30.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts