Question: Continued from the previous question. Assume that the floatation cost of new stock issuing is 6%. What is Global's cost of common stock if it

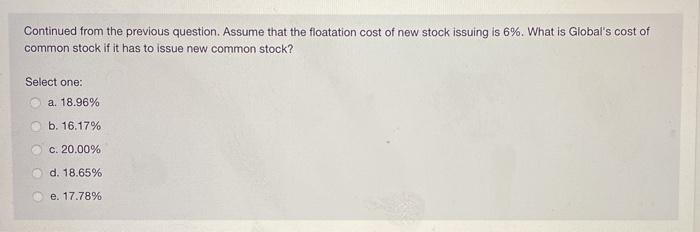

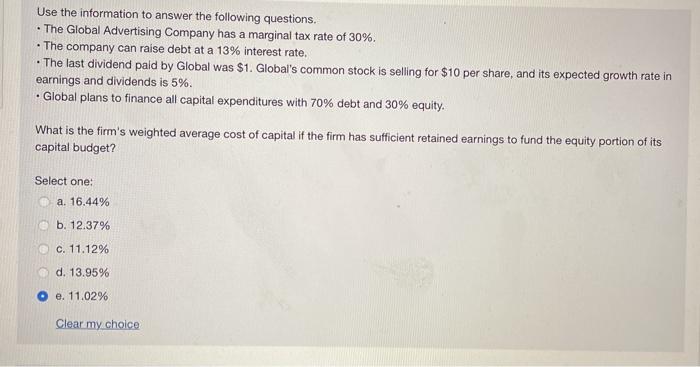

Continued from the previous question. Assume that the floatation cost of new stock issuing is 6%. What is Global's cost of common stock if it has to issue new common stock? Select one: a. 18.96% b. 16.17% c. 20.00% d. 18.65% e. 17.78% . Use the information to answer the following questions. The Global Advertising Company has a marginal tax rate of 30%. The company can raise debt at a 13% interest rate. The last dividend paid by Global was $1. Global's common stock is selling for $10 per share, and its expected growth rate in earnings and dividends is 5%. Global plans to finance all capital expenditures with 70% debt and 30% equity. What is the firm's weighted average cost of capital if the firm has sufficient retained earnings to fund the equity portion of its capital budget? Select one: a. 16.44% b. 12.37% C. 11.12% d. 13.95% e. 11.02% Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts