Question: continued . question e pertains to this sheet: please solve both sheets and explain. thank you . 2. Refer to original data The variable cost

continued . question e pertains to this sheet:

please solve both sheets and explain. thank you .

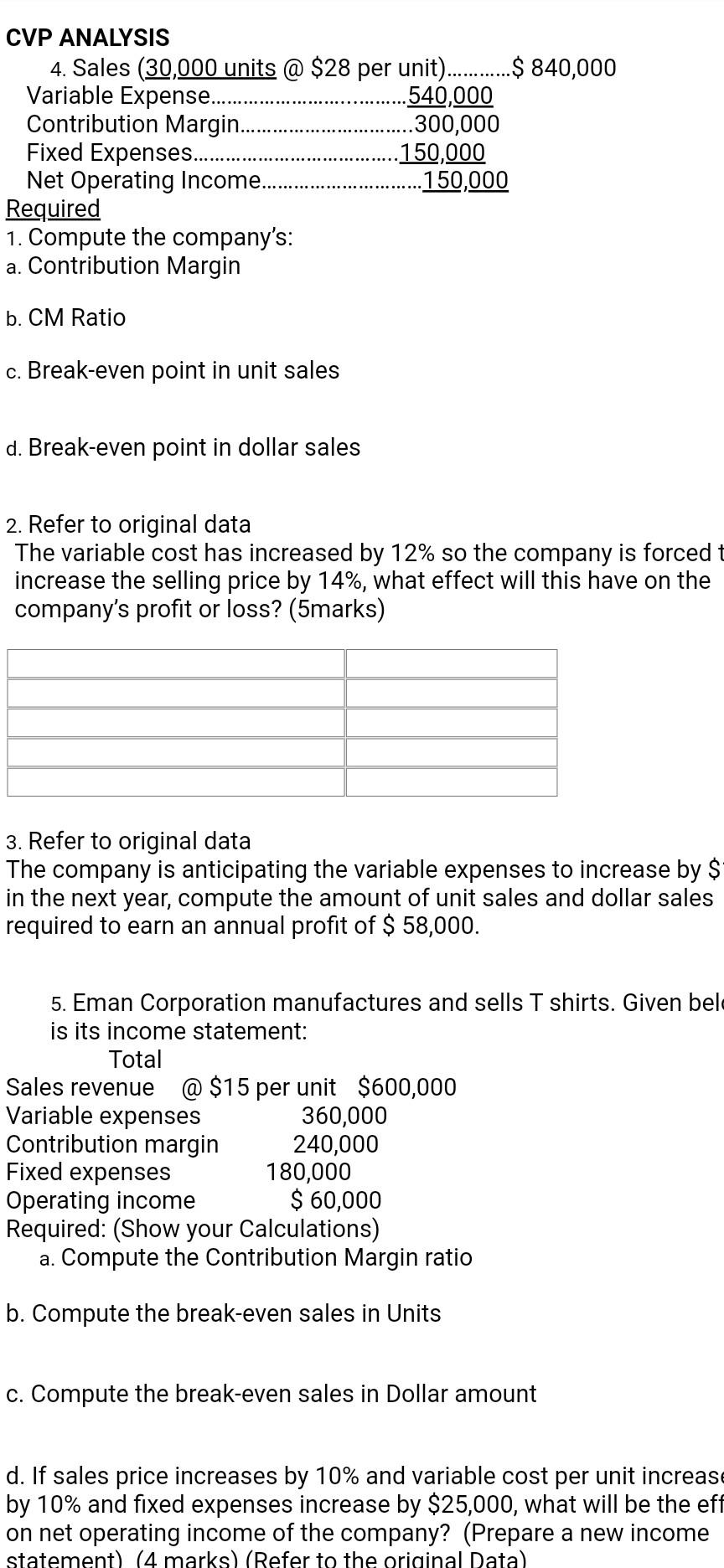

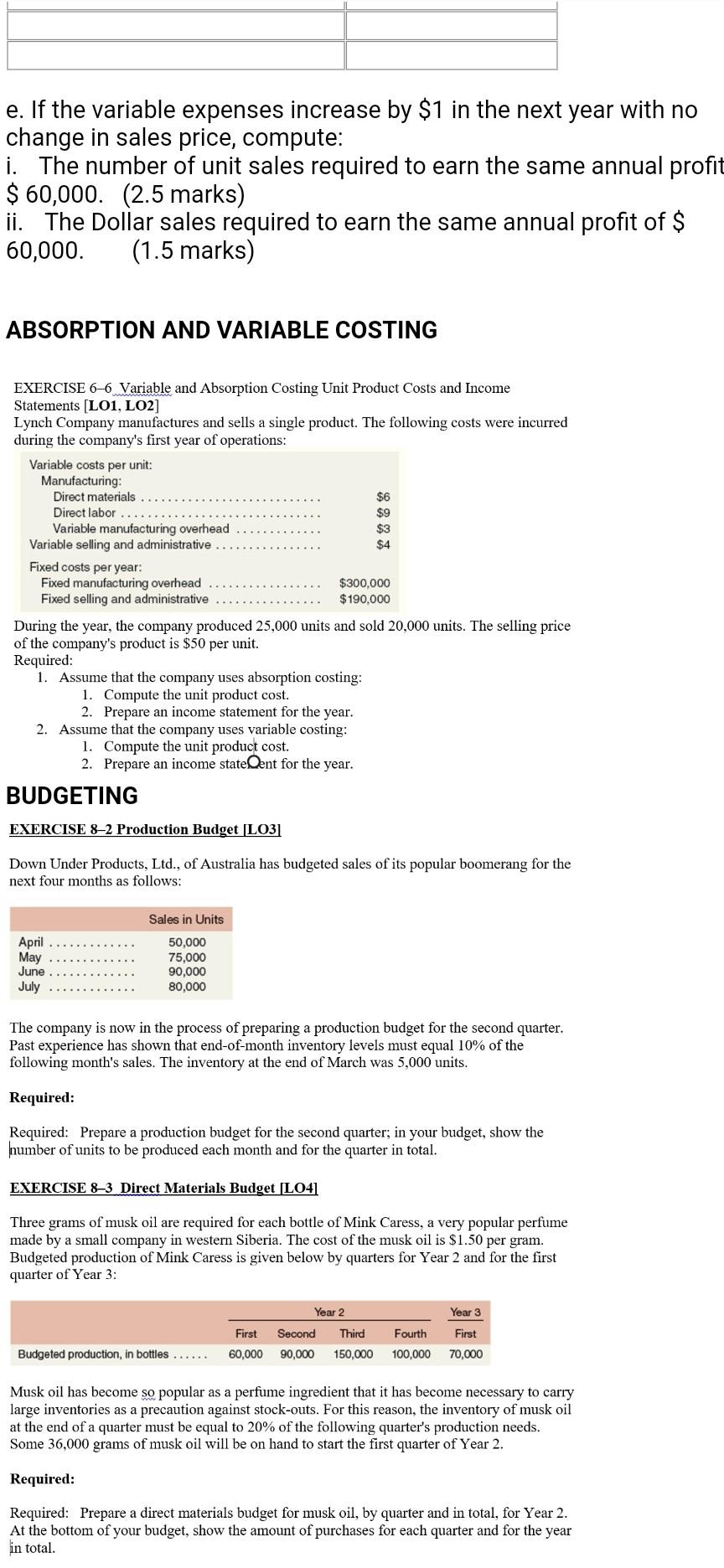

2. Refer to original data The variable cost has increased by 12% so the company is forced increase the selling price by 14%, what effect will this have on the company's profit or loss? (5marks) 3. Refer to original data The company is anticipating the variable expenses to increase by $ in the next year, compute the amount of unit sales and dollar sales required to earn an annual profit of $58,000. 5. Eman Corporation manufactures and sells T shirts. Given bel is its income statement: Total reyulieu. (oliuvr yuu valculalivis) a. Compute the Contribution Margin ratio b. Compute the break-even sales in Units c. Compute the break-even sales in Dollar amount d. If sales price increases by 10% and variable cost per unit increas by 10% and fixed expenses increase by $25,000, what will be the eff on net operating income of the company? (Prepare a new income statement) (4 marks) (Refer to the oriainal Data) e. If the variable expenses increase by $1 in the next year with no change in sales price, compute: i. The number of unit sales required to earn the same annual profi $60,000. (2.5 marks) ii. The Dollar sales required to earn the same annual profit of $ 60,000 . (1.5 marks) ABSORPTION AND VARIABLE COSTING EXERCISE 6-6 Variable and Absorption Costing Unit Product Costs and Income Statements [LO1,LO2] Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: During the year, the company produced 25,000 units and sold 20,000 units. The selling price of the company's product is $50 per unit. Required: 1. Assume that the company uses absorption costing: 1. Compute the unit product cost. 2. Prepare an income statement for the year. 2. Assume that the company uses variable costing: 1. Compute the unit product cost. 2. Prepare an income stateQent for the year. BUDGETING EXERCISE 8-2 Production Budget [LO3] Down Under Products, Ltd., of Australia has budgeted sales of its popular boomerang for the next four months as follows: The company is now in the process of preparing a production budget for the second quarter. Past experience has shown that end-of-month inventory levels must equal 10% of the following month's sales. The inventory at the end of March was 5,000 units. Required: Required: Prepare a production budget for the second quarter; in your budget, show the number of units to be produced each month and for the quarter in total. EXERCISE 8-3 Direct Materials Budget [LO4] Three grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $1.50 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: Musk oil has become so popular as a perfume ingredient that it has become necessary to carry large inventories as a precaution against stock-outs. For this reason, the inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 36,000 grams of musk oil will be on hand to start the first quarter of Year 2. Required: Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. At the bottom of your budget, show the amount of purchases for each quarter and for the year in total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts