Question: continued questions Problem 02.005 - New product value after development A rotary engine powers a vertical takeoff and landing (VTOL) personal aircraft known as the

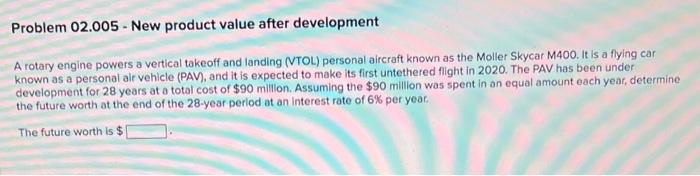

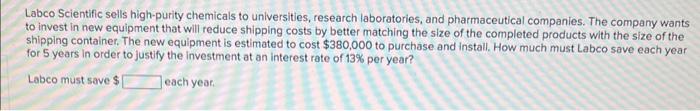

Problem 02.005 - New product value after development A rotary engine powers a vertical takeoff and landing (VTOL) personal aircraft known as the Moller Skycar M400. It is a flying car known as a personal air vehicle (PAV), and it is expected to make its first untethered flight in 2020. The PAV has been under development for 28 years at a total cost of $90 million. Assuming the $90 million was spent in an equal amount each year, determine the future worth at the end of the 28-year perlod at an interest rate of 6% per year. The future worth is $ Labco Scientific sells high-purity chemicals to universities, research laboratories, and pharmaceutical companies. The company wants to invest in new equipment that will reduce shipping costs by better matching the size of the completed products with the size of the shipping container. The new equipment is estimated to cost $380,000 to purchase and install. How much must Labco save each year for 5 years in order to justify the investment at an interest rate of 13% per year? Labco must save $ each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts