Question: Continuing Payroll Problem, 4B: Chapter 4 This problem continues the process of preparing the Olney Company's Employee Payroll Register for the pay period ending January

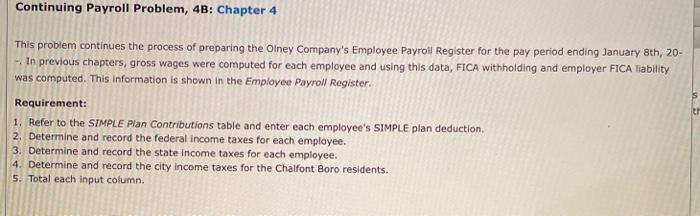

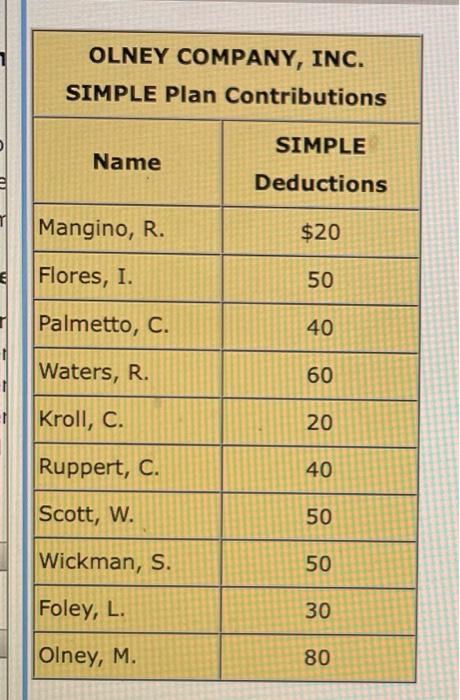

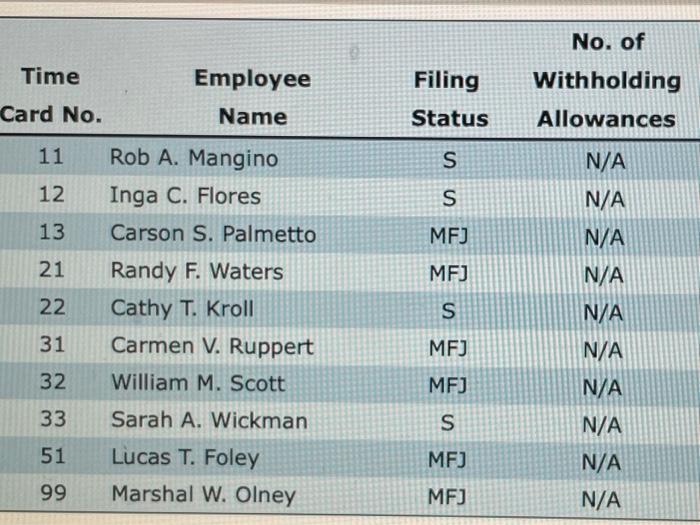

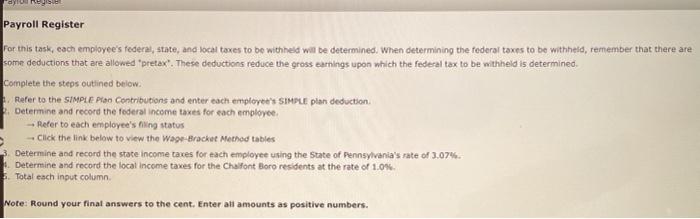

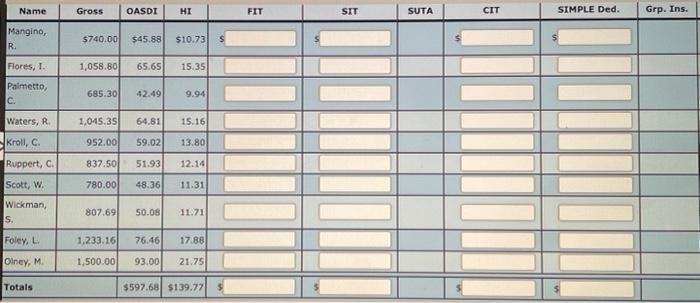

Continuing Payroll Problem, 4B: Chapter 4 This problem continues the process of preparing the Olney Company's Employee Payroll Register for the pay period ending January 8th, 20- - In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed. This information is shown in the Employee Payroll Register Requirement: 1. Refer to the SIMPLE Plan Contributions table and enter each employee's SIMPLE plan deduction 2. Determine and record the federal income taxes for each employee. 3. Determine and record the state income taxes for each employee. 4. Determine and record the city income taxes for the Chalfont Boro residents. 5. Total each input column. ! OLNEY COMPANY, INC. SIMPLE Plan Contributions SIMPLE Name Deductions Mangino, R. $20 Flores, I. 50 Palmetto, C. 40 Waters, R. 60 Kroll, C. 20 Ruppert, C. 40 Scott, W. 50 Wickman, S. 50 Foley, L. 30 Olney, M. 80 No. of Time Employee Filing Status Withholding Allowances Card No. Name 11 S 12 S N/A N/A N/A 13 MFJ 21 MFJ N/A Rob A. Mangino Inga C. Flores Carson S. Palmetto Randy F. Waters Cathy T. Kroll Carmen V. Ruppert William M. Scott Sarah A. Wickman 22 S N/A 31 MFJ N/A 32 MFJ N/A 33 S 51 MFJ Lucas T. Foley Marshal W. Olney N/A N/A N/A 99 MFJ NES Payroll Register For this task, each employee's federal, state, and local taxes to be withheld will be determined. When determining the federal taxes to be withheld, remember that there are some deductions that are allowed "pretax". These deductions reduce the gross earnings upon which the federal tax to be withheld is determined. Complete the steps outlined below. Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction Determine and record the federal income taxes for each employee - Refer to each employee's Aling status -- Click the link below to view the War-Bracket Method tables 3. Determine and record the state income taxes for each employee using the State of Pennsylvania's rate of 3.07% Determine and record the local income taves for the Chaifont Boro residents at the rate of 1.0%. Total each input column Note: Round your final answers to the cent. Enter all amounts as positive numbers. Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Ded. Grp. Ins. Mangino, R $740.00 $45.88 $10.73 Flores, L. 1,058.80 65.65 15.35 Palmetto c. 685.30 42.49 9.94 Waters, R 1.045.35 64.81 15.16 Kroll, C. 952.00 59.02 13.80 Ruppert, 837.50 51.93 12.14 Scott, W. 780.00 48.36 11.31 Wickman, S. 807.69 50.08 11.71 Foley, L 1.233.16 76.46 17.88 Olney, M 1,500.00 93.00 21.75 Totals $597.68 $139.77 Continuing Payroll Problem, 4B: Chapter 4 This problem continues the process of preparing the Olney Company's Employee Payroll Register for the pay period ending January 8th, 20- - In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed. This information is shown in the Employee Payroll Register Requirement: 1. Refer to the SIMPLE Plan Contributions table and enter each employee's SIMPLE plan deduction 2. Determine and record the federal income taxes for each employee. 3. Determine and record the state income taxes for each employee. 4. Determine and record the city income taxes for the Chalfont Boro residents. 5. Total each input column. ! OLNEY COMPANY, INC. SIMPLE Plan Contributions SIMPLE Name Deductions Mangino, R. $20 Flores, I. 50 Palmetto, C. 40 Waters, R. 60 Kroll, C. 20 Ruppert, C. 40 Scott, W. 50 Wickman, S. 50 Foley, L. 30 Olney, M. 80 No. of Time Employee Filing Status Withholding Allowances Card No. Name 11 S 12 S N/A N/A N/A 13 MFJ 21 MFJ N/A Rob A. Mangino Inga C. Flores Carson S. Palmetto Randy F. Waters Cathy T. Kroll Carmen V. Ruppert William M. Scott Sarah A. Wickman 22 S N/A 31 MFJ N/A 32 MFJ N/A 33 S 51 MFJ Lucas T. Foley Marshal W. Olney N/A N/A N/A 99 MFJ NES Payroll Register For this task, each employee's federal, state, and local taxes to be withheld will be determined. When determining the federal taxes to be withheld, remember that there are some deductions that are allowed "pretax". These deductions reduce the gross earnings upon which the federal tax to be withheld is determined. Complete the steps outlined below. Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction Determine and record the federal income taxes for each employee - Refer to each employee's Aling status -- Click the link below to view the War-Bracket Method tables 3. Determine and record the state income taxes for each employee using the State of Pennsylvania's rate of 3.07% Determine and record the local income taves for the Chaifont Boro residents at the rate of 1.0%. Total each input column Note: Round your final answers to the cent. Enter all amounts as positive numbers. Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Ded. Grp. Ins. Mangino, R $740.00 $45.88 $10.73 Flores, L. 1,058.80 65.65 15.35 Palmetto c. 685.30 42.49 9.94 Waters, R 1.045.35 64.81 15.16 Kroll, C. 952.00 59.02 13.80 Ruppert, 837.50 51.93 12.14 Scott, W. 780.00 48.36 11.31 Wickman, S. 807.69 50.08 11.71 Foley, L 1.233.16 76.46 17.88 Olney, M 1,500.00 93.00 21.75 Totals $597.68 $139.77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts