Question: Continuing Problem Chapter 2-Instruction #2 The following transactions were completed by PS Music during July, the second month of the business's operations: Analyze and journalize

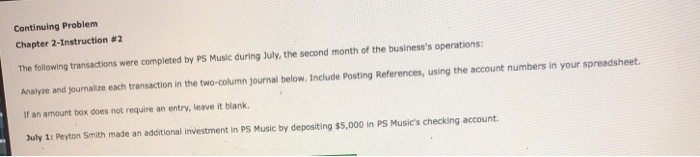

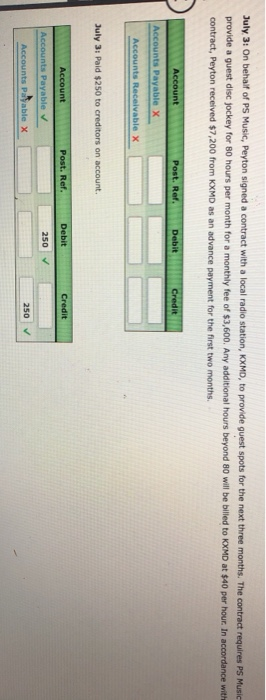

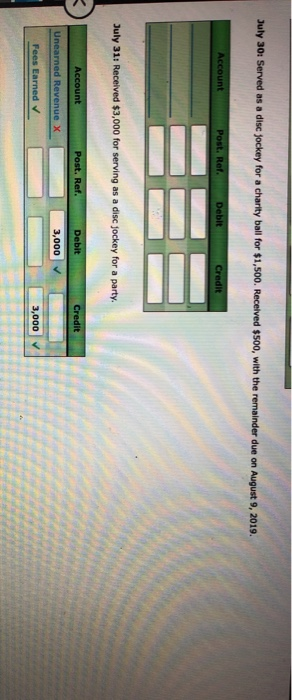

Continuing Problem Chapter 2-Instruction #2 The following transactions were completed by PS Music during July, the second month of the business's operations: Analyze and journalize each transaction in the two-column journal below. Include Posting References, using the account numbers in your spreadshe If an amount box does not require an entry, leave it blank. July 1: Peyton Smith made an additional investment in PS Music by depositing $5,000 in PS Music's checking account. Continuing Problem Chapter 2-Instruction #2 The following transactions were completed by PS Music during July, the second month of the business's operations: Analyze and journalize each transaction in the two column Journal below. Include Posting References, using the account numbers in your spreadsheet. If an amount box does not require an entry, leave it blank. July 1: Peyton Smith made an additional Investment in PS Music by depositing $5,000 in PS Music's checking account July 3: On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music provide a guest disc jockey for 80 hours per month for a monthly fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. In accordance with contract, Peyton received $7,200 from KXMD as an advance payment for the first two months. Account Post. Ref. Debit Credit Accounts Payable X Accounts Receivable X July 3: Paid $250 to creditors on account. Account Post. Ref. Debit Credit Accounts Payable 250 Accounts Payable X 250 V July 23: Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4, 2019. Account Post. Ref. Debit Credit July 27: Paid electric bill, $915. Account Post. Ref. Debit Credit Supplies Expense X 915 915 Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts