Question: >Continuing Problem P9-43 Calculating and journalizing partial-year depreciation This problem continues the Canyon Canoe Company situation from Chapter 8. Amber and Zack Wilson arc continuing

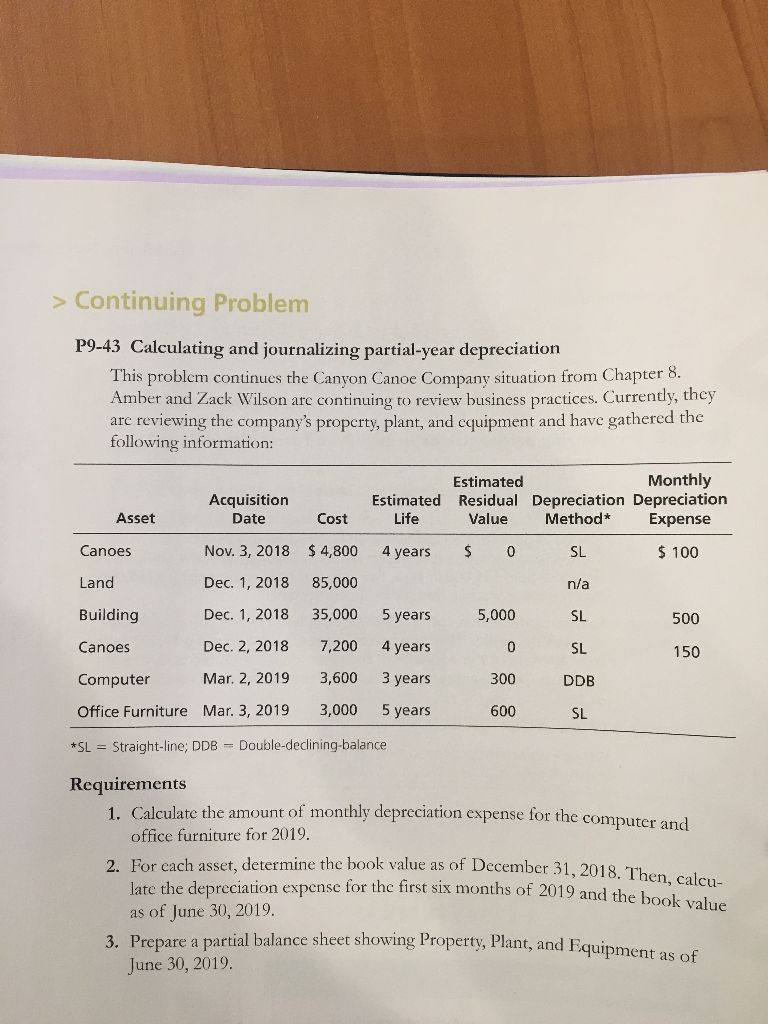

>Continuing Problem P9-43 Calculating and journalizing partial-year depreciation This problem continues the Canyon Canoe Company situation from Chapter 8. Amber and Zack Wilson arc continuing to review business practices. Currently, they are reviewing the company's property, plant, and cquipment and have gathered the following information: Monthly Estimated Residual Depreciation Depreciation Expense Estimated Acquisition Asset Life Method* Date Cost Value Nov. 3, 2018$4,800 $ 0 Canoes 100 4 years SL 85,000 Dec. 1, 2018 Land n/a Building Dec. 1, 2018 35,000 5 years 5,000 SL 500 Dec. 2, 2018 7,200 4 years Canoes 0 SL 150 3 years Mar. 2, 2019 3,600 Computer 300 DDB 3,000 5 years Office Furniture Mar. 3, 2019 600 SL *SL = Straight-line; DDB Double-declining-balance Requirements 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2019 2 For each asset, determine the book value as of December 31, 2018. Then, calcu late the depreciation expense for the first six months of 2019 and the book value as of June 30, 2019. 3. Prepare a partial balance sheet showing Property, Plant, and Fquipment as June 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts