Question: Continuing Problen P3-45 Preparing adjusting entries and preparing an adjusted trial balance This problem continues the Davis Consulting situation from Problem P2-43 of Chapter 2.

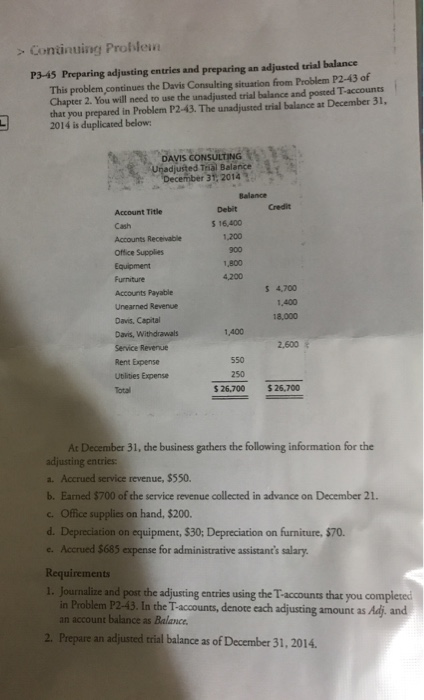

Continuing Problen P3-45 Preparing adjusting entries and preparing an adjusted trial balance This problem continues the Davis Consulting situation from Problem P2-43 of Chapter 2. You will need to use the unadjusted trial balance and posted T-accounts that you prepared in Problem P2-43. The unadjusted trial balance at December 31, 2014 is duplicated below: DAVIS CONSULTING Unadjusted Trial Balance December 31, 2014 Balance Credit Debit Account Title 5 16,400 Cash 1,200 Accounts Receivable 900 Office Supplies 1.800 Equipment 4,200 Furniture $ 4,700 Accounts Payable 1,400 Unearned Revenue 18,000 Davis, Capital 1,400 Davis, Withdrawals 2.600 Service Revenue 550 Rent Expense 250 Utlities Expense $26,700 $ 26,700 Total At December 31, the business gathers the following information for the adjusting entries a. Accrued service revenue, $550. b. Earned $700 of the service revenue collected in advance on December 21. on hand, $200. c. Office supplies d. Depreciation on equipment, $30; Depreciation on furniture, $70. e. Accrued $685 expense for administrative assistant's salary. Requirements 1. Journalize and post the adjusting entries using the T-accounts that you completed in Problem P2-43. In the T-accounts, denote each adjusting Adj, and amount as an account balance as Balance Prepare an adjusted trial balance as of December 31, 2014. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts