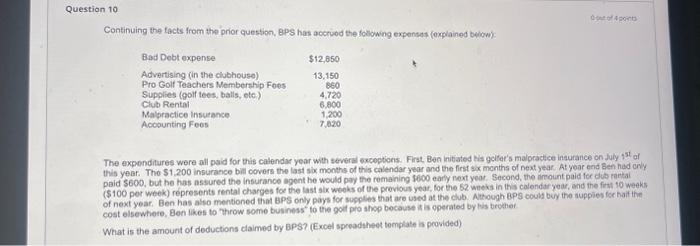

Question: Continuing the facts from the prior question, Bps has accriod the folowing expenses (explained beliom): The expenditures were all paid for this calendar year with

Continuing the facts from the prior question, Bps has accriod the folowing expenses (explained beliom): The expenditures were all paid for this calendar year with several oxcoptions. First, Ben initated tis geiler's malpradice ingurance on July 13t af this year. Tho $1.200 insurance bill covers the last six months of this calendar year and the first six months of next year. At year end Ben hed orly paid $600, but he has assured the insurance agent he would poy the remaining 1000 early rext year. Second, the amrount paid for dib rarkal (\$100 per weok) represents rental charges foe the last sik weeks of the provicous year, for the 52 wateks in tha calendar year, and the firl 10 weeks of next year. Ben has a'so mentioned that BPS only pays for supples that are used at the club. Although BPS could buy the auppies for hait the : cost elsewhere. Ben likes to Throw some business' to the goif pro ahop because is is operated by lis brether. What is the amount of deductions claimed by BPS? (Excel spreadaheet tomplate is provided)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts