Question: Continuing with the above example, if the trader buys the bond at 105.500 , what are the potential projected annual rates of return? (In other

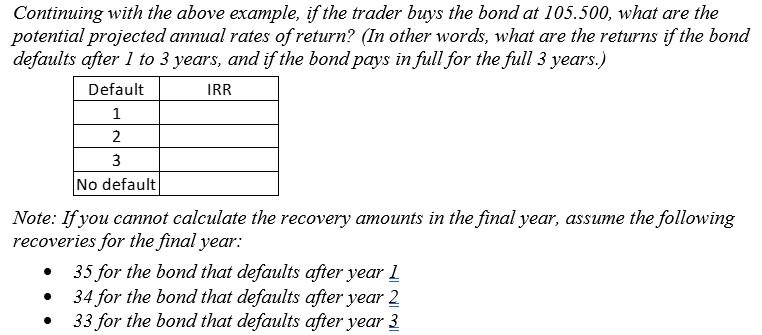

Continuing with the above example, if the trader buys the bond at 105.500 , what are the potential projected annual rates of return? (In other words, what are the returns if the bond defaults after 1 to 3 years, and if the bond pays in full for the full 3 years.) Note: If you cannot calculate the recovery amounts in the final year, assume the following recoveries for the final year: - 35 for the bond that defaults after year 1 - 34 for the bond that defaults after year 2 - 33 for the bond that defaults after year 3 Continuing with the above example, if the trader buys the bond at 105.500 , what are the potential projected annual rates of return? (In other words, what are the returns if the bond defaults after 1 to 3 years, and if the bond pays in full for the full 3 years.) Note: If you cannot calculate the recovery amounts in the final year, assume the following recoveries for the final year: - 35 for the bond that defaults after year 1 - 34 for the bond that defaults after year 2 - 33 for the bond that defaults after year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts