Question: Part A: The Sunset Property Fund is an international portfolio with holdings in Indonesian Real Estate shares, Singaporean Real Estate stocks and Australian government

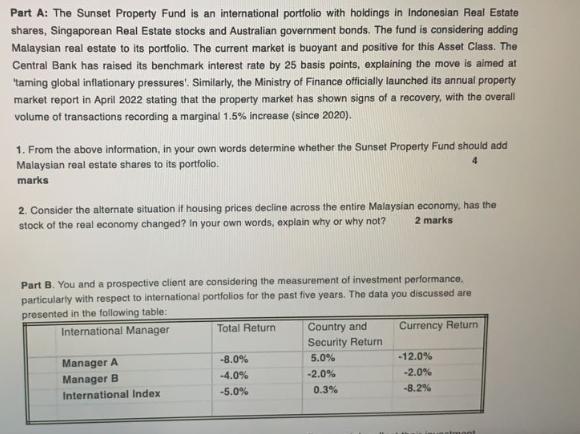

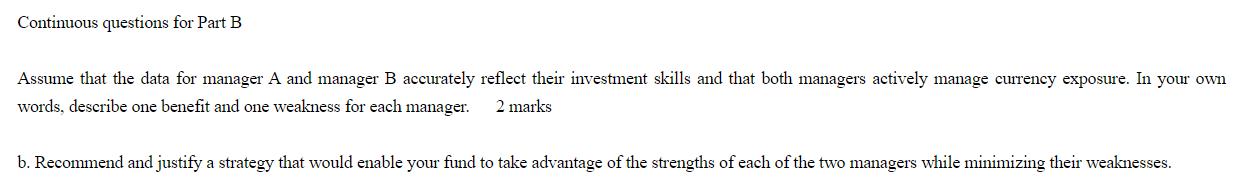

Part A: The Sunset Property Fund is an international portfolio with holdings in Indonesian Real Estate shares, Singaporean Real Estate stocks and Australian government bonds. The fund is considering adding Malaysian real estate to its portfolio. The current market is buoyant and positive for this Asset Class. The Central Bank has raised its benchmark interest rate by 25 basis points, explaining the move is aimed at taming global inflationary pressures'. Similarly, the Ministry of Finance officially launched its annual property market report in April 2022 stating that the property market has shown signs of a recovery, with the overall volume of transactions recording a marginal 1.5% increase (since 2020). 4 1. From the above information, in your own words determine whether the Sunset Property Fund should add Malaysian real estate shares to its portfolio. marks 2. Consider the alternate situation if housing prices decline across the entire Malaysian economy, has the stock of the real economy changed? In your own words, explain why or why not? 2 marks Part B. You and a prospective client are considering the measurement of investment performance. particularly with respect to international portfolios for the past five years. The data you discussed are presented in the following table: International Manager Total Return Country and Currency Return Security Return Manager A -8.0% 5.0% -12.0% Manager B -4.0% -2.0% -2.0% International Index -5.0% 0.3% -8.2% Continuous questions for Part B Assume that the data for manager A and manager B accurately reflect their investment skills and that both managers actively manage currency exposure. In your own words, describe one benefit and one weakness for each manager. 2 marks b. Recommend and justify a strategy that would enable your fund to take advantage of the strengths of each of the two managers while minimizing their weaknesses.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Part A 1 Whether Sunset Property Fund should add Malaysian real estate shares to its portfolio depends on various factors Given the positive market sentiment and the recent actions of the Central Bank ... View full answer

Get step-by-step solutions from verified subject matter experts