Question: continuous time finance (b) (13 marks) Let T be a fixed terminal horizon. We recall that in Bachelier's model, the stock price (under the historical

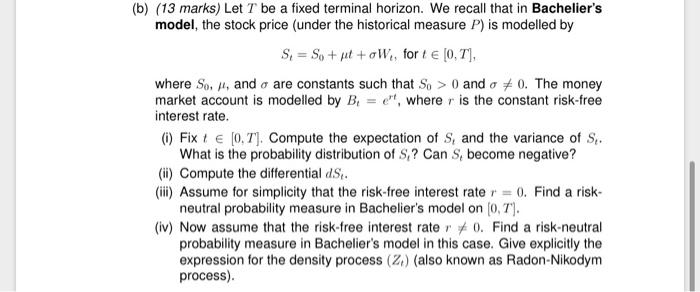

(b) (13 marks) Let T be a fixed terminal horizon. We recall that in Bachelier's model, the stock price (under the historical measure P) is modelled by Si = So + put +oW., for t (0,7), where So. , and o are constants such that So > 0 and o 70. The money market account is modelled by B= c", where is the constant risk-free interest rate. () Fix + (0.7). Compute the expectation of S, and the variance of S. What is the probability distribution of S? Can S, become negative? (ii) Compute the differential ds. (ii) Assume for simplicity that the risk-free interest rate r = 0. Find a risk- neutral probability measure in Bachelier's model on (0,7). (iv) Now assume that the risk-free interest rate r *0. Find a risk-neutral probability measure in Bachelier's model in this case. Give explicitly the expression for the density process (2) (also known as Radon-Nikodym process). (b) (13 marks) Let T be a fixed terminal horizon. We recall that in Bachelier's model, the stock price (under the historical measure P) is modelled by Si = So + put +oW., for t (0,7), where So. , and o are constants such that So > 0 and o 70. The money market account is modelled by B= c", where is the constant risk-free interest rate. () Fix + (0.7). Compute the expectation of S, and the variance of S. What is the probability distribution of S? Can S, become negative? (ii) Compute the differential ds. (ii) Assume for simplicity that the risk-free interest rate r = 0. Find a risk- neutral probability measure in Bachelier's model on (0,7). (iv) Now assume that the risk-free interest rate r *0. Find a risk-neutral probability measure in Bachelier's model in this case. Give explicitly the expression for the density process (2) (also known as Radon-Nikodym process)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts