Question: Contract Masters Ltd has entered into a contract with Creative Dealers Ltd. for the construction of a new branch office. The contract began on

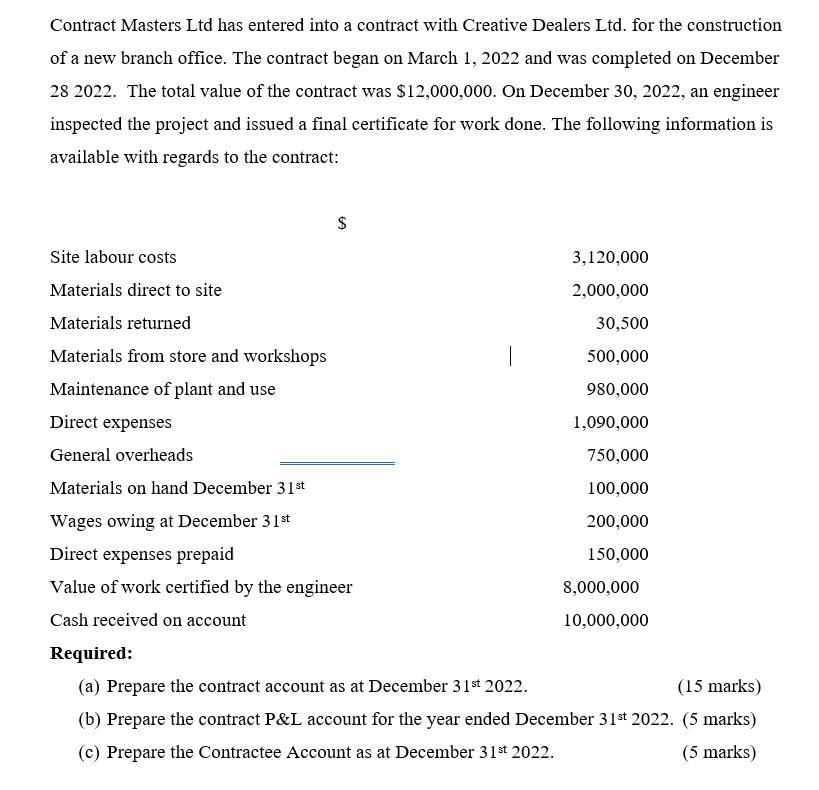

Contract Masters Ltd has entered into a contract with Creative Dealers Ltd. for the construction of a new branch office. The contract began on March 1, 2022 and was completed on December 28 2022. The total value of the contract was $12,000,000. On December 30, 2022, an engineer inspected the project and issued a final certificate for work done. The following information is available with regards to the contract: Site labour costs Materials direct to site Materials returned Materials from store and workshops Maintenance of plant and use Direct expenses General overheads Materials on hand December 31st $ Wages owing at December 31st Direct expenses prepaid Value of work certified by the engineer Cash received on account | 3,120,000 2,000,000 30,500 500,000 980,000 1,090,000 750,000 100,000 200,000 150,000 8,000,000 10,000,000 Required: (a) Prepare the contract account as at December 31st 2022. (15 marks) (b) Prepare the contract P&L account for the year ended December 31st 2022. (5 marks) (c) Prepare the Contractee Account as at December 31st 2022. (5 marks)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Contract Account for the year ended December 31 2022 Description Amount Site labor cost... View full answer

Get step-by-step solutions from verified subject matter experts