Question: Consider an open-economy IS-LM model. The domestic economy is small relative to the world economy. Also, assume that domestic and foreign inflation and expected

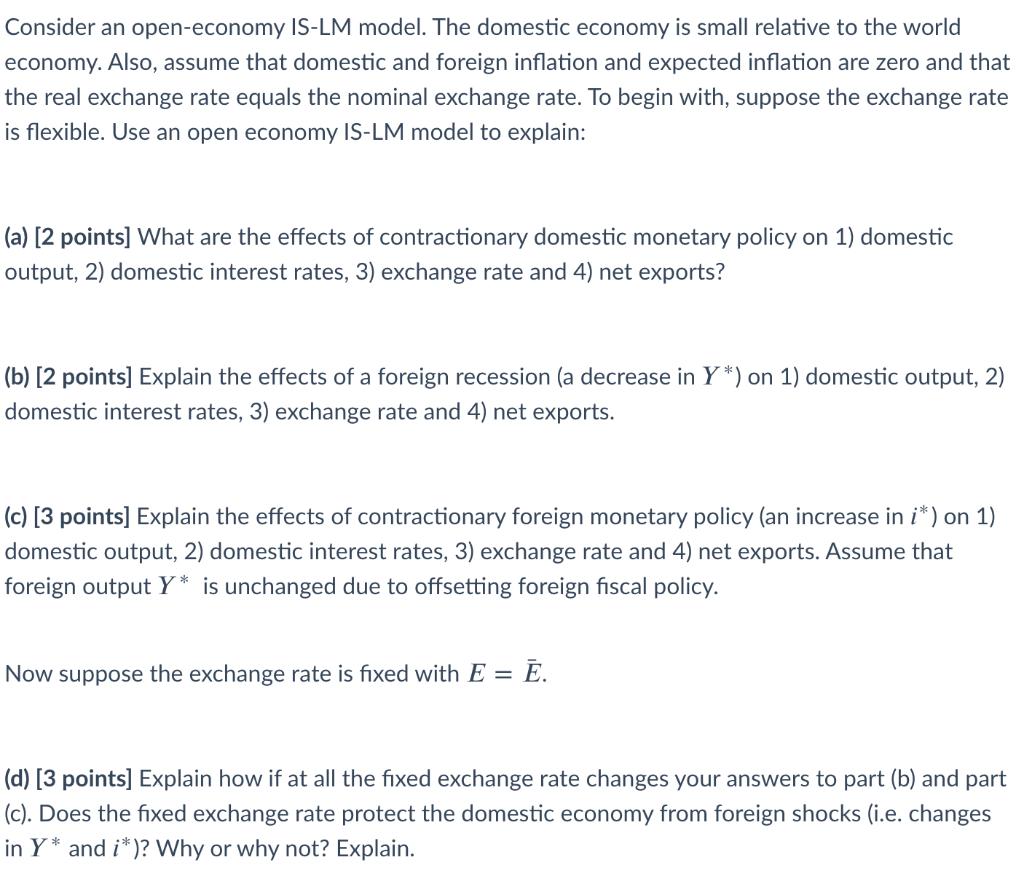

Consider an open-economy IS-LM model. The domestic economy is small relative to the world economy. Also, assume that domestic and foreign inflation and expected inflation are zero and that the real exchange rate equals the nominal exchange rate. To begin with, suppose the exchange rate is flexible. Use an open economy IS-LM model to explain: (a) [2 points] What are the effects of contractionary domestic monetary policy on 1) domestic output, 2) domestic interest rates, 3) exchange rate and 4) net exports? (b) [2 points] Explain the effects of a foreign recession (a decrease in Y*) on 1) domestic output, 2) domestic interest rates, 3) exchange rate and 4) net exports. (c) [3 points] Explain the effects of contractionary foreign monetary policy (an increase in i*) on 1) domestic output, 2) domestic interest rates, 3) exchange rate and 4) net exports. Assume that foreign output Y* is unchanged due to offsetting foreign fiscal policy. Now suppose the exchange rate is fixed with E = . (d) [3 points] Explain how if at all the fixed exchange rate changes your answers to part (b) and part (c). Does the fixed exchange rate protect the domestic economy from foreign shocks (i.e. changes in Y* and i*)? Why or why not? Explain.

Step by Step Solution

3.38 Rating (173 Votes )

There are 3 Steps involved in it

a Contractionary domestic monetary policy will lead to a decrease in domestic output an increase in domestic interest rates an appreciation of the exchange rate and a decrease in net exports The decre... View full answer

Get step-by-step solutions from verified subject matter experts