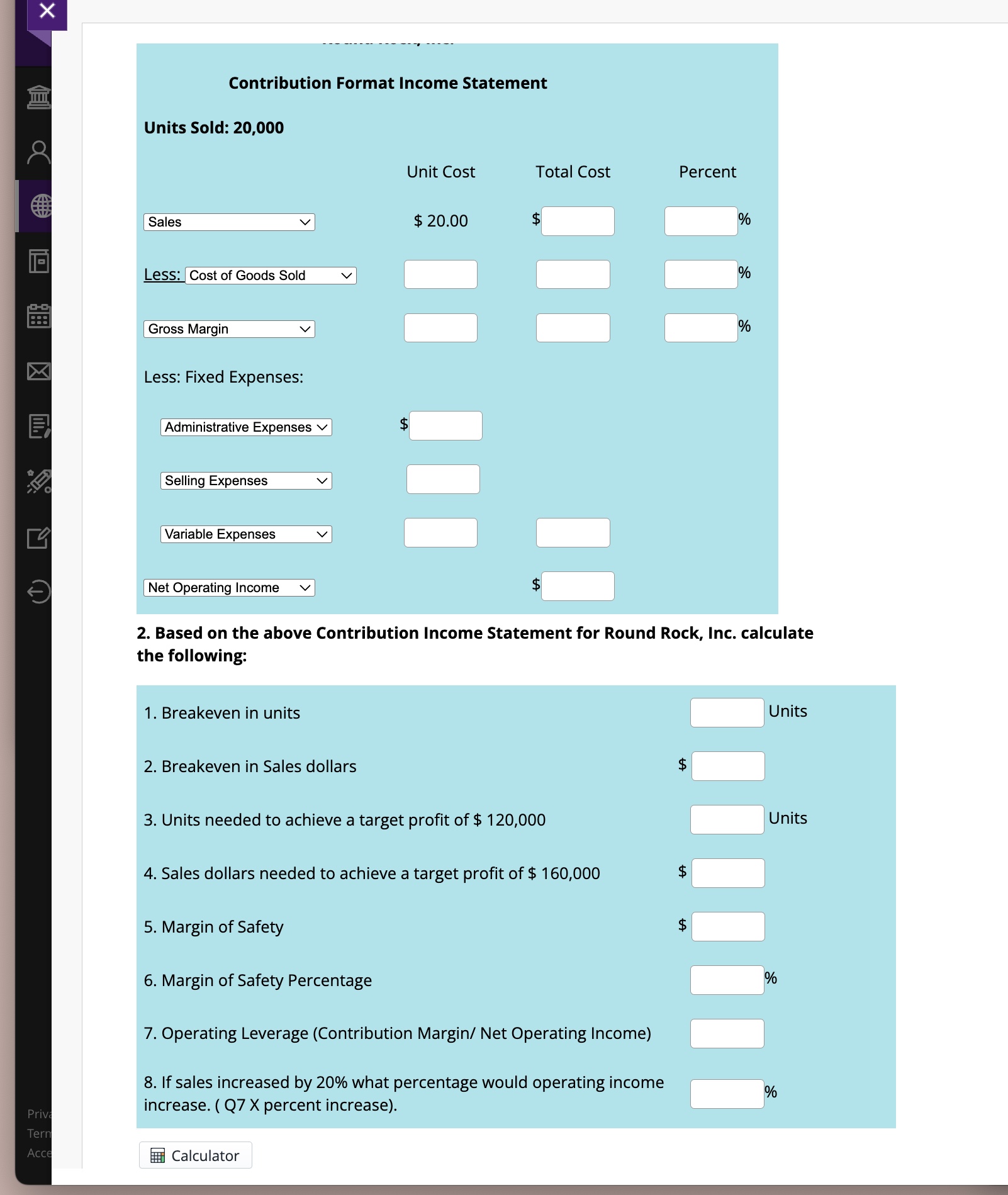

Question: Contribution Format Income Statement Units Sold: 2 0 , 0 0 0 Selling ExpensesVariable Expenses 2 . Based on the above Contribution Income Statement for

Contribution Format Income Statement Units Sold: Selling ExpensesVariable Expenses Based on the above Contribution Income Statement for Round Rock, Inc. calculate the following: Breakeven in units Breakeven in Sales dollars Units needed to achieve a target profit of $ Sales dollars needed to achieve a target profit of $ Margin of Safety Margin of Safety Percentage Operating Leverage Contribution Margin Net Operating Income If sales increased by what percentage would operating income increase. Q X percent increase Units $ Units $ $ Round Rock,Inc. manufactures and sells a single product. Cost data are given below: Variable cost per unit

Fixed Cost$

$ Variable cost per unit

Fixed Selling Expenses$

$ Variable cost per unit

Fixed Administrative Expenses$

$

Prepare the Contribution Format Income Statement.

Round Rock, Inc.

Contribution Format Income Statement

Units Sold:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock