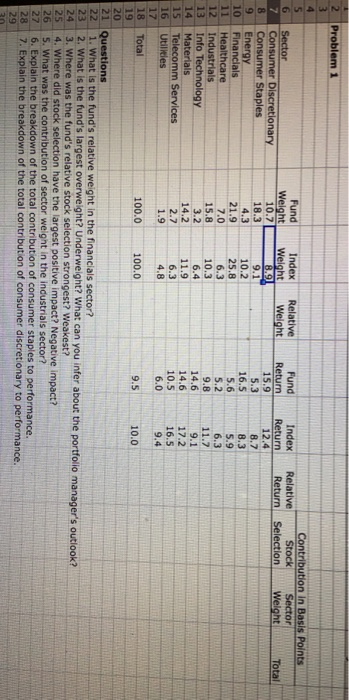

Question: Contribution in Basis Points Fund Stock Sector - weight-Return-Return Return Selection weight Index Relative IndexRelative WeightWeight Total Consumer Discretionary 10.7 8 Consumer Staples 16.5 5.6

Contribution in Basis Points Fund Stock Sector - weight-Return-Return Return Selection weight Index Relative IndexRelative WeightWeight Total Consumer Discretionary 10.7 8 Consumer Staples 16.5 5.6 5.2 9.8 14.6 14.6 10.5 6.0 10 Financials 11 Healthcare 12 Industrials 13 Info Technology 10.2 25.8 6.3 10.3 5.9 6.3 11.7 21.9 7.0 3.2 14.2 15 Telecomm Services 11.9 6.3 17.2 16.5 16 Utilities 100.0 100.0 9.5 10.0 19 20 22 1. What's the fund's relative weight in the financials sector? 23 2. What is the fund's largest overweight? Underweight? What can you infer about the portfolio manager's outlook? 24 3. Where was the fund's relative stock selection strongest? Weakest? 25 4. Where did stock selection have the largest positive impact? Negative impact? 26 5. What was the contribution of sector weight in the industrials sector? 27 6. Explain the breakdown of the total contribution of consumer staples to performance 28 7.Explain the breakdown of the total contribution of consumer discretionary to performance 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts