Question: Contribution margin analysissales Instructions Labels and Amount Descriptions Contribution Margin Analysis X Instructions The following data for Romero Products Inc. are available: For the Year

Contribution margin analysissales

Instructions

Labels and Amount Descriptions

Contribution Margin Analysis

X

Instructions

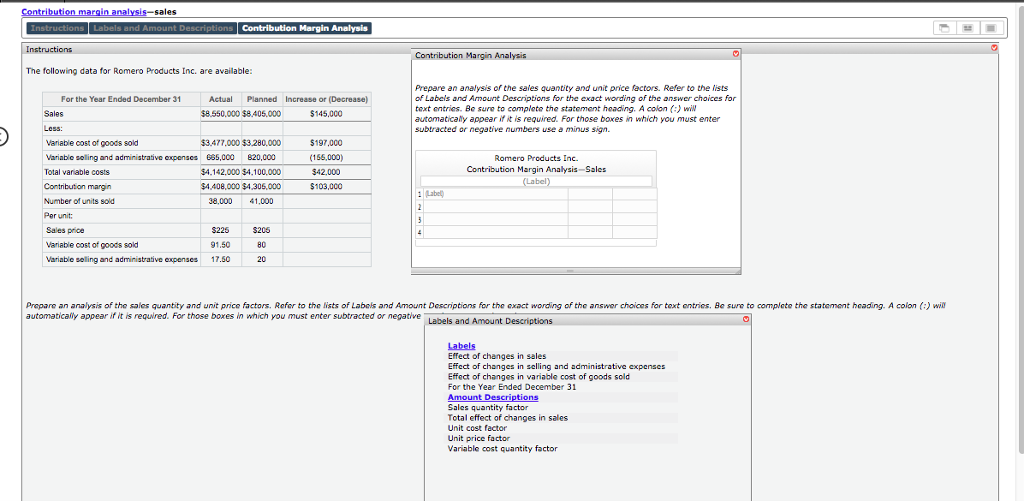

The following data for Romero Products Inc. are available:

| For the Year Ended December 31 | Actual | Planned | Increase or (Decrease) |

| Sales | $8,550,000 | $8,405,000 | $145,000 |

| Less: | |||

| Variable cost of goods sold | $3,477,000 | $3,280,000 | $197,000 |

| Variable selling and administrative expenses | 665,000 | 820,000 | (155,000) |

| Total variable costs | $4,142,000 | $4,100,000 | $42,000 |

| Contribution margin | $4,408,000 | $4,305,000 | $103,000 |

| Number of units sold | 38,000 | 41,000 | |

| Per unit: | |||

| Sales price | $225 | $205 | |

| Variable cost of goods sold | 91.50 | 80 | |

| Variable selling and administrative expenses | 17.50 | 20 |

Prepare an analysis of the sales quantity and unit price factors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

X

Labels and Amount Descriptions

| Labels | |

| Effect of changes in sales | |

| Effect of changes in selling and administrative expenses | |

| Effect of changes in variable cost of goods sold | |

| For the Year Ended December 31 | |

| Amount Descriptions | |

| Sales quantity factor | |

| Total effect of changes in sales | |

| Unit cost factor | |

| Unit price factor | |

| Variable cost quantity factor |

X

Contribution Margin Analysis

Prepare an analysis of the sales quantity and unit price factors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

| Romero Products Inc. |

| Contribution Margin AnalysisSales |

| 1 |

|

| ||||||||||||||||||||

| 2 |

| |||||||||||||||||||||

| 3 |

| |||||||||||||||||||||

| 4 |

|

Prepare an analysis of the sales quantity and unit price factors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

|

Margin Analysis Contribution Margin The following data for Romero Products Inc. are available Prepare an analysis of the sales quantity and unit price lectors. Refer to the lists of Labels and Amount Desciptions for the exact wording of the answer choices for text entries. Bo sure to complote the statemont heading. A colon (:) wit automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign For the Year Ended December 31 Actual Planned Increase or (Decrease) $8.550,000 $8.405.000 $145.000 ess: Variable cost of goods sold Variable seling and administrative cxpenses 65,C00 B20,c00 Total variable costs Contribution margin Number of units sold Per unit: Sales price Variable cost of goods sold Variable seling and administrative expenses 17.50 3.477.000 $3.280,000 5197,000 (155,000) $42.000 $103,000 Romero Products Inc. Contribution Margin Analysis Sales $4.142.000 $4,100,000 $4.408,000 $4.305,000 38,000 41,000 S205 80 20 S225 91.50 Prepare an analysis of the sales quantity and unit prico factors. Refor to the lists of Labols and Amount Descriptions for the exact wording of the answer choices for text ontries. Be sure to complato the statement heading. A colon (;) wi automatically appear if it is reguwred. For those boxes in which you must enter subtracted or negative ls and Amount Descriptions Labels Effect of changes in sales Effect of changes in selling and administrative expenses Effect of changes in variable cost of goods sold For the Year Ended December 31 Sales quantity factor Total effect of changes in sales Unit cost factor Unit price factor Variable cost quantity factor Margin Analysis Contribution Margin The following data for Romero Products Inc. are available Prepare an analysis of the sales quantity and unit price lectors. Refer to the lists of Labels and Amount Desciptions for the exact wording of the answer choices for text entries. Bo sure to complote the statemont heading. A colon (:) wit automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign For the Year Ended December 31 Actual Planned Increase or (Decrease) $8.550,000 $8.405.000 $145.000 ess: Variable cost of goods sold Variable seling and administrative cxpenses 65,C00 B20,c00 Total variable costs Contribution margin Number of units sold Per unit: Sales price Variable cost of goods sold Variable seling and administrative expenses 17.50 3.477.000 $3.280,000 5197,000 (155,000) $42.000 $103,000 Romero Products Inc. Contribution Margin Analysis Sales $4.142.000 $4,100,000 $4.408,000 $4.305,000 38,000 41,000 S205 80 20 S225 91.50 Prepare an analysis of the sales quantity and unit prico factors. Refor to the lists of Labols and Amount Descriptions for the exact wording of the answer choices for text ontries. Be sure to complato the statement heading. A colon (;) wi automatically appear if it is reguwred. For those boxes in which you must enter subtracted or negative ls and Amount Descriptions Labels Effect of changes in sales Effect of changes in selling and administrative expenses Effect of changes in variable cost of goods sold For the Year Ended December 31 Sales quantity factor Total effect of changes in sales Unit cost factor Unit price factor Variable cost quantity factor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts