Question: Contribution Margin Ratio, Variable Cost Ratio, Break - Even Sales Revenue The controller of Jeong Company prepared the following projected income statement: Required: Calculate the

Contribution Margin Ratio, Variable Cost Ratio, BreakEven Sales Revenue

The controller of Jeong Company prepared the following projected income statement:

Required:

Calculate the contribution margin ratio. Note: Enter as a percent, rounded to the nearest whole number.

Calculate the variable cost ratio. Note: Enter as a percent, rounded to the nearest whole number.

Calculate the breakeven sales revenue for Jeong. Note: Round your answer to the nearest dollar.

$

How could Jeong increase projected operating income without increasing the total sales revenue?

Decrease variable cost andor fixed cost

Decrease the contribution margin ratio

Add more people to the sales force

None of the above

Contribution Margin Ratio, Variable Cost Ratio, BreakEven Sales Revenue

The controller of Jeong Company prepared the following projected income statement:

Required:

Calculate the contribution margin ratio. Note: Enter as a percent, rounded to the nearest whole number.

Calculate the variable cost ratio. Note: Enter as a percent, rounded to the nearest whole number.

Calculate the breakeven sales revenue for Jeong. Note: Round your answer to the nearest dollar.

$

How could Jeong increase projected operating income without increasing the total sales revenue?

Decrease variable cost andor fixed cost

Decrease the contribution margin ratio

Add more people to the sales force

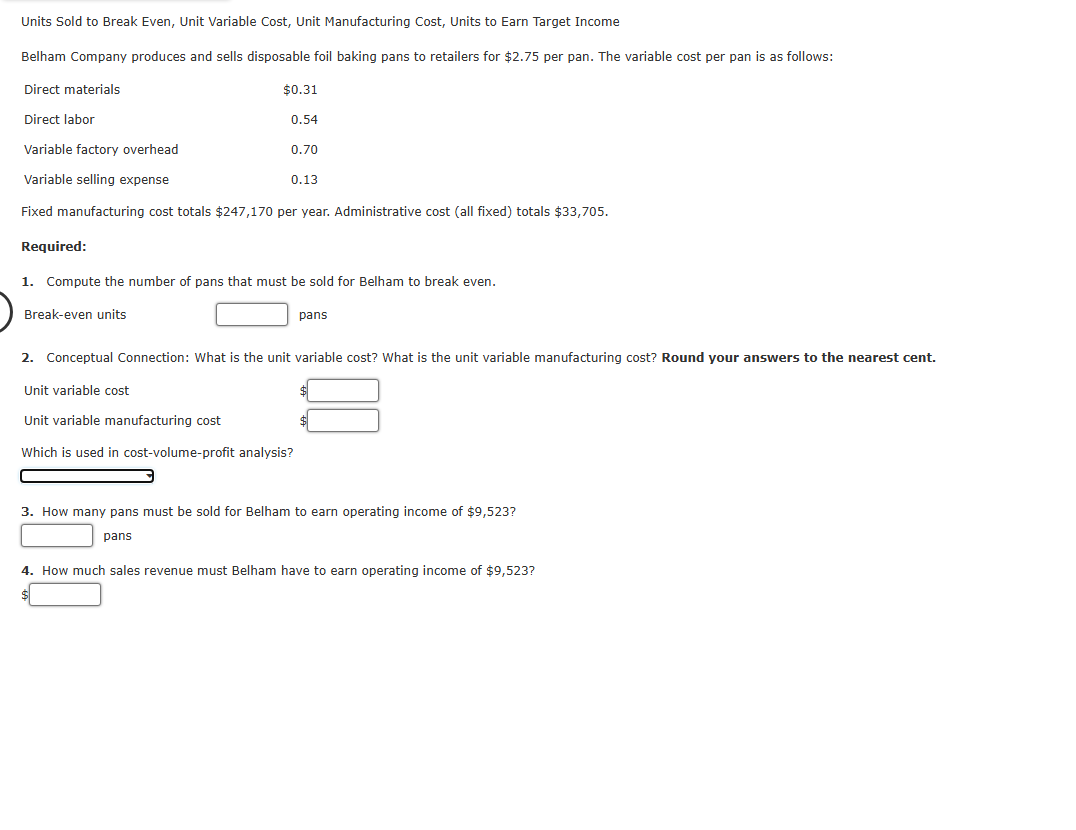

None of the aboveUnits Sold to Break Even, Unit Variable Cost, Unit Manufacturing Cost, Units to Earn Target Income

Belham Company produces and sells disposable foil baking pans to retailers for $ per pan. The variable cost per pan is as follows:

Line Item DescriptionCostDirect materials$Direct laborVariable factory overheadVariable selling expense

Fixed manufacturing cost totals $ per year. Administrative cost all fixed totals $

Required:

Compute the number of pans that must be sold for Belham to break even.

Line Item DescriptionAnswerBreakeven unitsfill in the blank pans

Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent.

Line Item DescriptionCostUnit variable cost$fill in the blank Unit variable manufacturing cost$fill in the blank

Which is used in costvolumeprofit analysis?

Unit variable manufacturing costUnit variable cost

How many pans must be sold for Belham to earn operating income of $

fill in the blank of pans

How much sales revenue must Belham have to earn operating income of $

fill in the blank of $

Units Sold to Break Even, Unit Variable Cost, Unit Manufacturing Cost, Units to Earn Target Income

Belham Company produces and sells disposable foil baking pans to retailers for $ per pan. The variable cost per pan is as follows:

Fixed manufacturing cost totals $ per year. Administrative cost all fixed totals $

Required:

Compute the number of pans that must be sold for Belham to break even.

Breakeven units

pans

Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent.

Unit variable cost

$

Unit variable manufacturing cost

$

Which is used in costvolumeprofit analysis?

How many pans must be sold for Belham to earn operating income of $

pans

How much sales revenue must Belham have to earn operating income of $

$

THE QUESTION WITH THE BOX HAS THE OPTIONS "unit variable manufacturing costs" "Unit variable costs"

PLEASE REPLY WITH CLEAR ANSWERS FOR EACH BOX. THANK YOU!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock