Question: Convert below to Excel as NPV and Pro Forma. Convert the above to Excel as NPV and Pro-Forma. Five Year Discounted Cash Flow Property is

Convert below to Excel as NPV and Pro Forma.

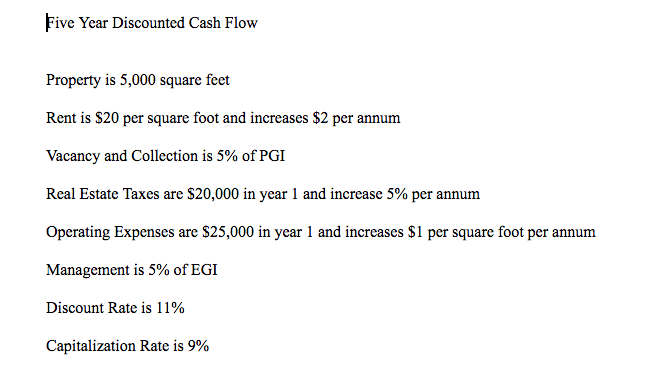

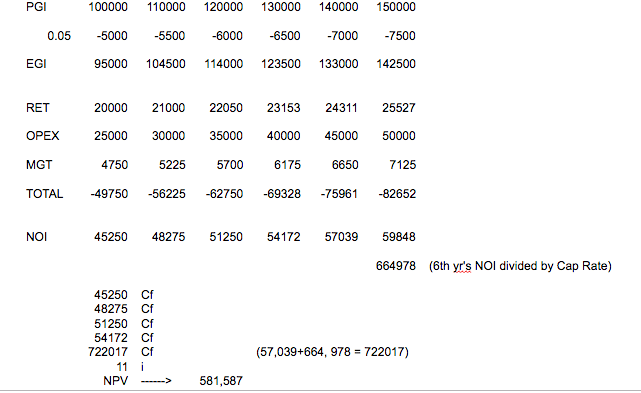

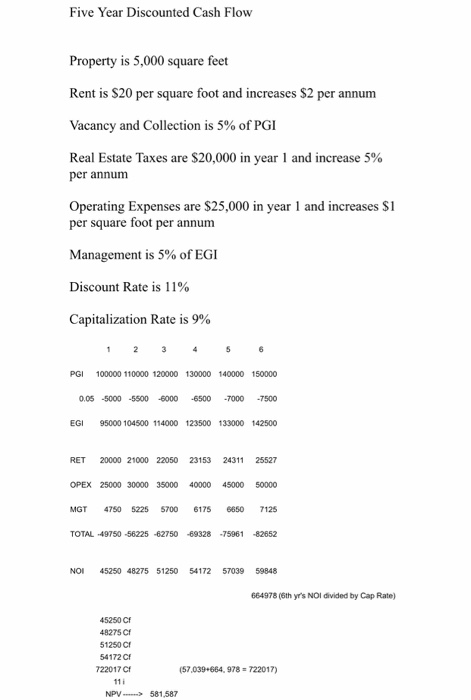

Five Year Discounted Cash Flow Property is 5,000 square feet Rent is S20 per square foot and increases S2 per annum Vacancy and Collection is 5% of PGI Real Estate Taxes are $20,000 in year 1 and increase 5% per annum Operating Expenses are S25,000 in year 1 and increases S1 per square foot per annum Management is 5% of EGI Discount Rate is 11% Capitalization Rate is 9% PGI 100000110000 120000 130000 140000 150000 0.05 -5000 -5500 -6000 -6500 7000 -7500 95000 104500 114000 123500 133000 142500 EGI RET MGT TOTAL -49750 -56225 -62750 -69328 -75961 -82652 20000 21000 22050 23153 24311 25527 25000 30000 35000 40000 45000 50000 7125 4750 5225 5700 6175 6650 NOI 45250 48275 51250 54172 57039 59848 664978 6th yr's NOl divided by Cap Rate) 45250 Cf 48275 Cf 51250 Cf 54172 Cf 722017 Cf (57,039+664, 978- 722017) >581,587 Five Year Discounted Cash Flow Property is 5,000 square feet Rent is S20 per square foot and increases $2 per annum Vacancy and Collection is 5% of PGI Real Estate Taxes are $20,000 in year 1 and increase 5% per annum Operating Expenses are $25,000 in year 1 and increases $1 per square foot per annum Management is 5% of EGI Discount Rate is 11% Capitalization Rate is 9% PGI 100000 110000 120000 130000 140000 150000 0.05 -5000 -5500 -6000 -6500 7O00 7500 EGI 95000 104500 114000 123500 133000 142500 RET 20000 21000 22050 23153 24311 25527 OPEX 25000 30000 35000 40000 45000 50000 MGT 4750 5225 5700 6175 6650 7125 TOTAL-49750-56225-62750-69328-75961-12652 NOI 45250 48275 51250 54172 57039 59848 664978 (6th yr's NOI divided by Cap Rate) 45250 Cf 48275 Cf 51250 C 54172 Cf 22017 C (57,039 664, 978 722017) NPV 581.587 Five Year Discounted Cash Flow Property is 5,000 square feet Rent is S20 per square foot and increases S2 per annum Vacancy and Collection is 5% of PGI Real Estate Taxes are $20,000 in year 1 and increase 5% per annum Operating Expenses are S25,000 in year 1 and increases S1 per square foot per annum Management is 5% of EGI Discount Rate is 11% Capitalization Rate is 9% PGI 100000110000 120000 130000 140000 150000 0.05 -5000 -5500 -6000 -6500 7000 -7500 95000 104500 114000 123500 133000 142500 EGI RET MGT TOTAL -49750 -56225 -62750 -69328 -75961 -82652 20000 21000 22050 23153 24311 25527 25000 30000 35000 40000 45000 50000 7125 4750 5225 5700 6175 6650 NOI 45250 48275 51250 54172 57039 59848 664978 6th yr's NOl divided by Cap Rate) 45250 Cf 48275 Cf 51250 Cf 54172 Cf 722017 Cf (57,039+664, 978- 722017) >581,587 Five Year Discounted Cash Flow Property is 5,000 square feet Rent is S20 per square foot and increases $2 per annum Vacancy and Collection is 5% of PGI Real Estate Taxes are $20,000 in year 1 and increase 5% per annum Operating Expenses are $25,000 in year 1 and increases $1 per square foot per annum Management is 5% of EGI Discount Rate is 11% Capitalization Rate is 9% PGI 100000 110000 120000 130000 140000 150000 0.05 -5000 -5500 -6000 -6500 7O00 7500 EGI 95000 104500 114000 123500 133000 142500 RET 20000 21000 22050 23153 24311 25527 OPEX 25000 30000 35000 40000 45000 50000 MGT 4750 5225 5700 6175 6650 7125 TOTAL-49750-56225-62750-69328-75961-12652 NOI 45250 48275 51250 54172 57039 59848 664978 (6th yr's NOI divided by Cap Rate) 45250 Cf 48275 Cf 51250 C 54172 Cf 22017 C (57,039 664, 978 722017) NPV 581.587

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts