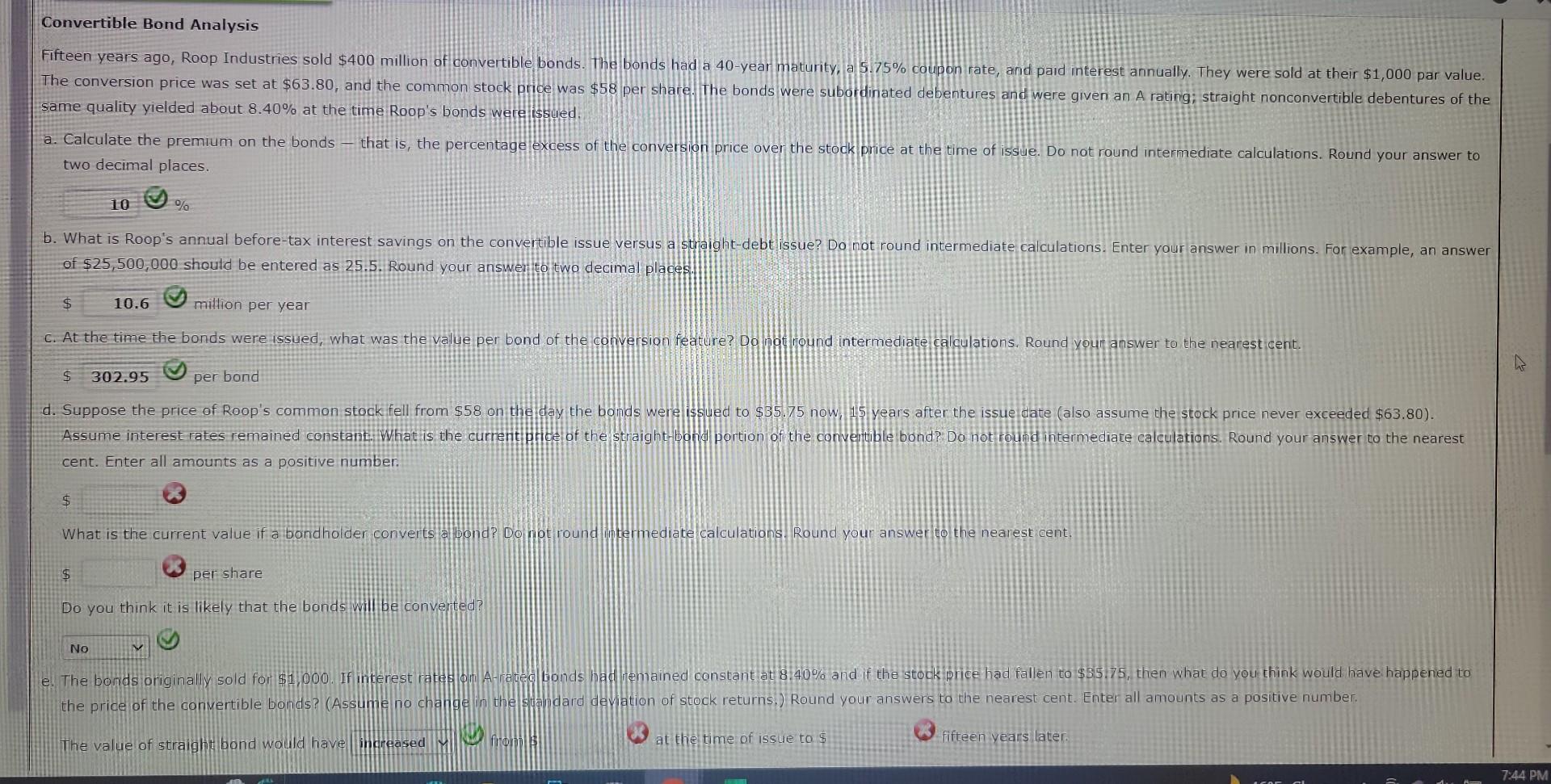

Question: Convertible Bond Analysis same quality yielded about 8.40% at the time Roop's bonds were ssuled. two decimal places. of $25,500,000 should be entered as 25.5.

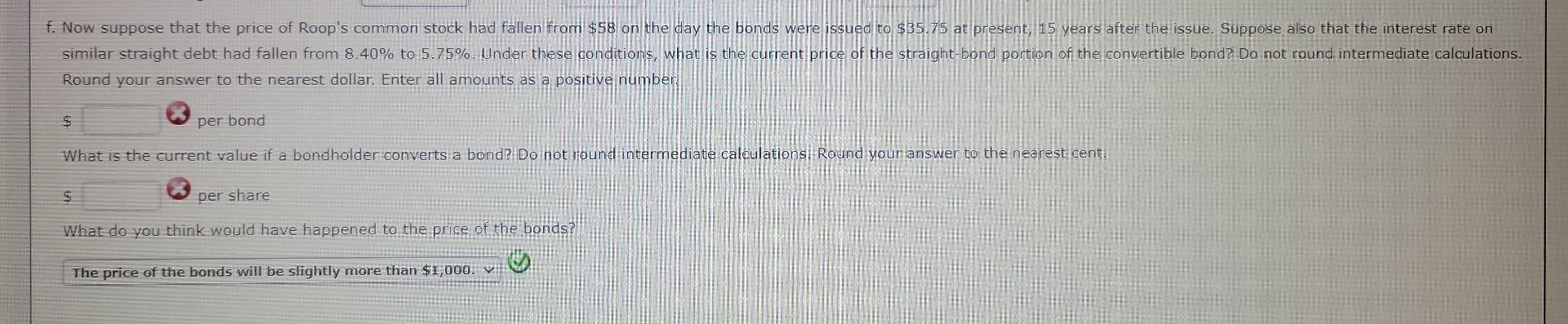

Convertible Bond Analysis same quality yielded about 8.40% at the time Roop's bonds were ssuled. two decimal places. of $25,500,000 should be entered as 25.5. Round your answer to two decimal places. . cent. Enter all amounts as a positive number. What is the current value if a bondholder converts a bond? Do not round infermediate calculations. Round your answer to the nearest cent. $ per share Do you think it is likely that the bonds will be converted? The value of straight bond would have Round your answer to the nearest dollar. Enter all amounts as a positive number What is the current value if a bondholder converts a bond? Do not yound intermediate caloulations: Round your answer to the nearest cent: 5 per share What do you think would have happened to the price of the bonds? The price of the bonds will be slightly more than $1,000 Convertible Bond Analysis same quality yielded about 8.40% at the time Roop's bonds were ssuled. two decimal places. of $25,500,000 should be entered as 25.5. Round your answer to two decimal places. . cent. Enter all amounts as a positive number. What is the current value if a bondholder converts a bond? Do not round infermediate calculations. Round your answer to the nearest cent. $ per share Do you think it is likely that the bonds will be converted? The value of straight bond would have Round your answer to the nearest dollar. Enter all amounts as a positive number What is the current value if a bondholder converts a bond? Do not yound intermediate caloulations: Round your answer to the nearest cent: 5 per share What do you think would have happened to the price of the bonds? The price of the bonds will be slightly more than $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts