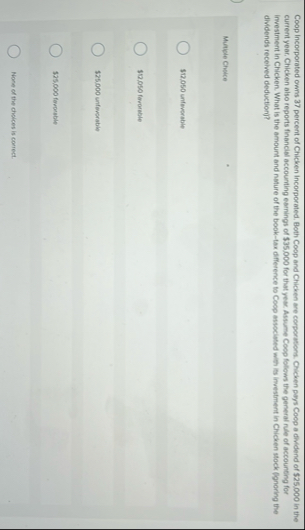

Question: Coop incorporated ows 3 7 percent of Chicken Incorporated. Both Coop and Chicken are corporations. Ciicken pays Coop a dividend of $ 2 5 .

Coop incorporated ows percent of Chicken Incorporated. Both Coop and Chicken are corporations. Ciicken pays Coop a dividend of $ in the current year. Chicken also reports financial accounting easings of $ for that reas. Assume Coop follows the general nule of accounting for investment in Chicken. What is the amount and nature of the booktax difference to Coop associated with is investment in Chicken stock fgnoring the thitends recetved deductiont?

Muliple Choice

unfeversbie

$ forornble

$ unfergrabie

foronable

None of the choices is corect.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock