Question: Cooperton Mining just announced it will cut its dividend from $5.18 to $3.58 per share and use the extra funds to expand. Prior to the

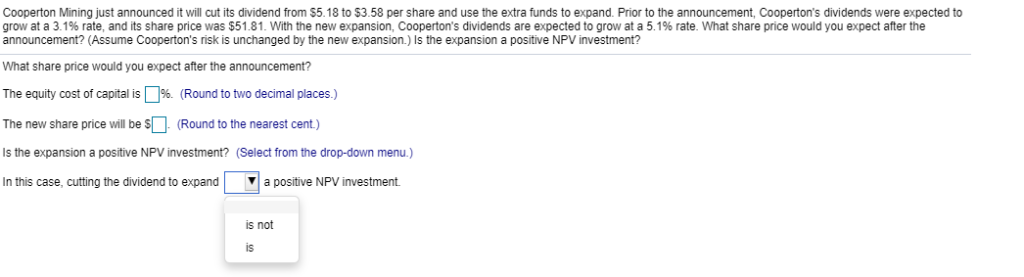

Cooperton Mining just announced it will cut its dividend from $5.18 to $3.58 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.1% rate, and its share price was $51.81. With the new expansion, Cooperton's dividends are expected to grow at a 5.1% rate. What share price would you expect after the announcement? (Assume Cooperton's risk is unchanged by the new expansion.) Is the expansion a positive NPV investment? What share price would you expect after the announcement? The equity cost of capital is (Round to two decimal places.) The new share price will be S(Round to the nearest cent.) Is the expansion a positive NPV investment? (Select from the drop-down menu.) positive NPV investment. In this case, cutting the dividend to expand is not is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts