Question: Cooperton Mining just announced it will cut its dividend from $5.12 to $3.32 per share and use the extra funds to expand. Prior to the

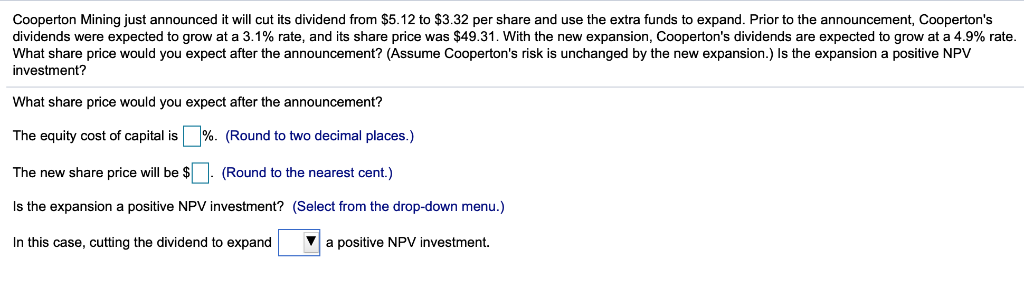

Cooperton Mining just announced it will cut its dividend from $5.12 to $3.32 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.1% rate, and its share price was $49.31. With the new expansion, Cooperton's dividends are expected to grow at a 4.9% rate What share price would you expect after the announcement? (Assume Cooperton's risk is unchanged by the new expansion.) Is the expansion a positive NPV investment? What share price would you expect after the announcement? The equity cost of capital is [ ]%. (Round to two decimal places.) The new share price will be s(Round to the nearest cent) Is the expansion a positive NPV investment? (Select from the drop-down menu.) In this case, cutting the dividend to expanda positive NPV investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts