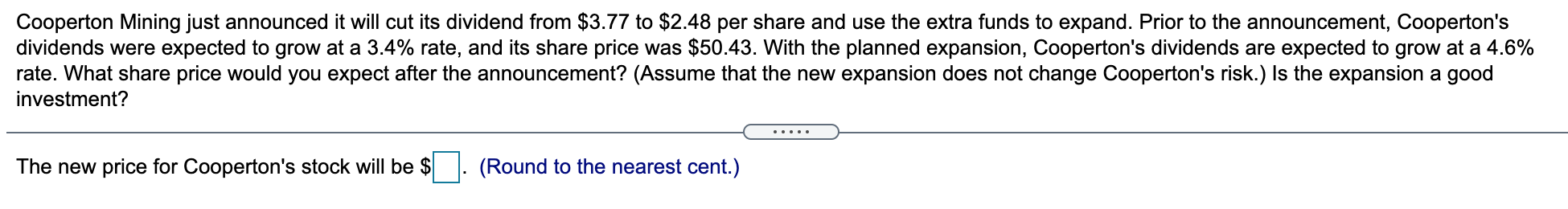

Question: Cooperton Mining just announced it will cut its dividend from $3.77 to $2.48 per share and use the extra funds to expand. Prior to the

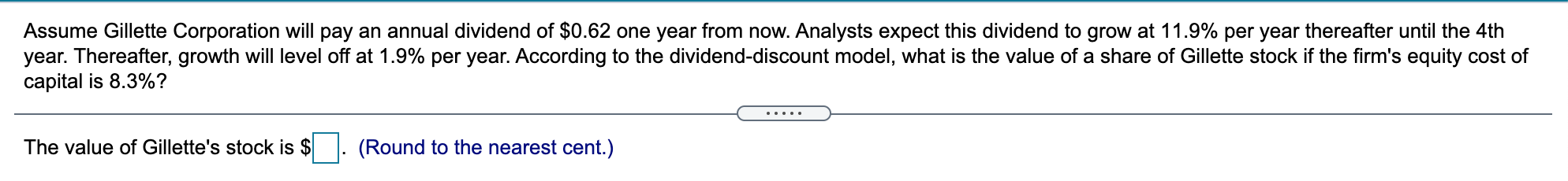

Cooperton Mining just announced it will cut its dividend from $3.77 to $2.48 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.4% rate, and its share price was $50.43. With the planned expansion, Cooperton's dividends are expected to grow at a 4.6% rate. What share price would you expect after the announcement? (Assume that the new expansion does not change Cooperton's risk.) Is the expansion a good investment? The new price for Cooperton's stock will be $ (Round to the nearest cent.) Assume Gillette Corporation will pay an annual dividend of $0.62 one year from now. Analysts expect this dividend to grow at 11.9% per year thereafter until the 4th year. Thereafter, growth will level off at 1.9% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.3%? The value of Gillette's stock is $O. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts