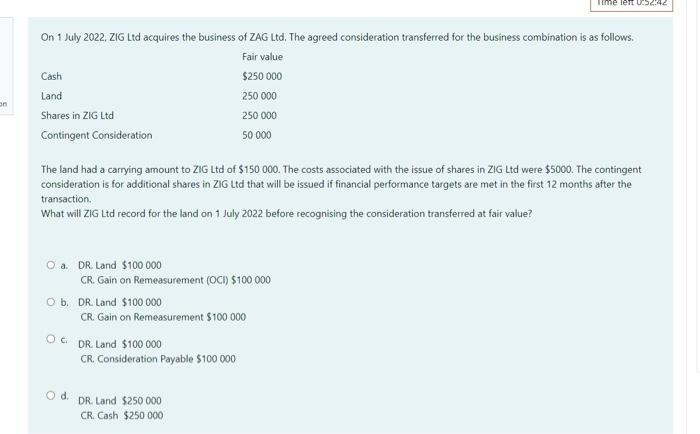

Question: coperating accouting and reporting On 1 July 2022, ZIG Ltd acquires the business of ZAG Ltd. The agreed consideration transferred for the business combination is

On 1 July 2022, ZIG Ltd acquires the business of ZAG Ltd. The agreed consideration transferred for the business combination is as follows. The land had a carrying amount to ZIG Ltd of $150.000. The costs associated with the issue of shares in ZIG Ltd were $5000. The contingent consideration is for additional shares in ZIG Ltd that will be issued if financial performance targets are met in the first 12 months after the transaction. What will ZIG Ltd record for the land on 1 July 2022 before recognising the consideration transferred at fair value? a. DR. Land $100000 CR. Gain on Remeasurement (OCI) $100000 b. DR. Land $100000 CR. Gain on Remeasurement $100000 c. DR. Land $100000 CR. Consideration Payable $100000 d. DR. Land $250000 CR. Cash $250000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts