Question: COPMANY IS MICROSOFT you should find the data from (microsoft) investing or yaho I don't have much time please help , Please form an excel

COPMANY IS MICROSOFT

you should find the data from (microsoft) investing or yaho

I don't have much time please help ,

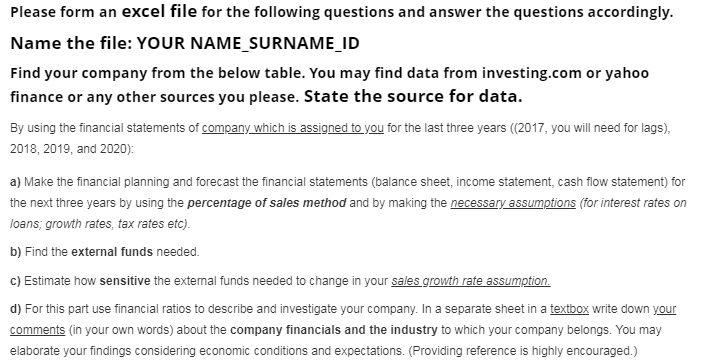

Please form an excel file for the following questions and answer the questions accordingly. Name the file: YOUR NAME_SURNAME_ID Find your company from the below table. You may find data from investing.com or yahoo finance or any other sources you please. State the source for data. By using the financial statements of company which is assigned to you for the last three years (2017, you will need for lags), 2018, 2019, and 2020): a) Make the financial planning and forecast the financial statements (balance sheet, income statement, cash flow statement) for the next three years by using the percentage of sales method and by making the necessary assumptions (for interest rates on loans, growth rates, tax rates etc). b) Find the external funds needed. C) Estimate how sensitive the external funds needed to change in your sales growth rate assumption. d) For this part use financial ratios to describe and investigate your company. In a separate sheet in a textbox write down your comments (in your own words) about the company financials and the industry to which your company belongs. You may elaborate your findings considering economic conditions and expectations. (Providing reference is highly encouraged.) Please form an excel file for the following questions and answer the questions accordingly. Name the file: YOUR NAME_SURNAME_ID Find your company from the below table. You may find data from investing.com or yahoo finance or any other sources you please. State the source for data. By using the financial statements of company which is assigned to you for the last three years (2017, you will need for lags), 2018, 2019, and 2020): a) Make the financial planning and forecast the financial statements (balance sheet, income statement, cash flow statement) for the next three years by using the percentage of sales method and by making the necessary assumptions (for interest rates on loans, growth rates, tax rates etc). b) Find the external funds needed. C) Estimate how sensitive the external funds needed to change in your sales growth rate assumption. d) For this part use financial ratios to describe and investigate your company. In a separate sheet in a textbox write down your comments (in your own words) about the company financials and the industry to which your company belongs. You may elaborate your findings considering economic conditions and expectations. (Providing reference is highly encouraged.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts