Question: Copy - Paste BIU . B . S.A- $ - % Conditional Format as Cell & Fill - Format Painter Merge & Center Insert Delete

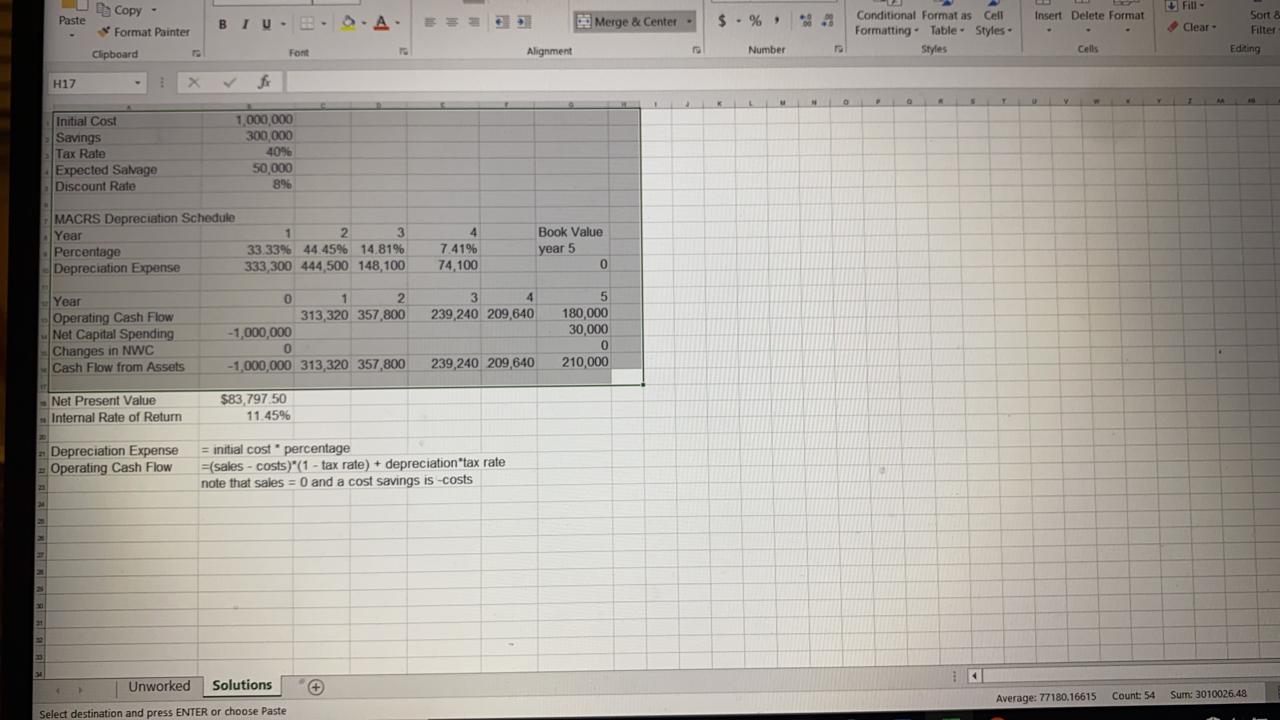

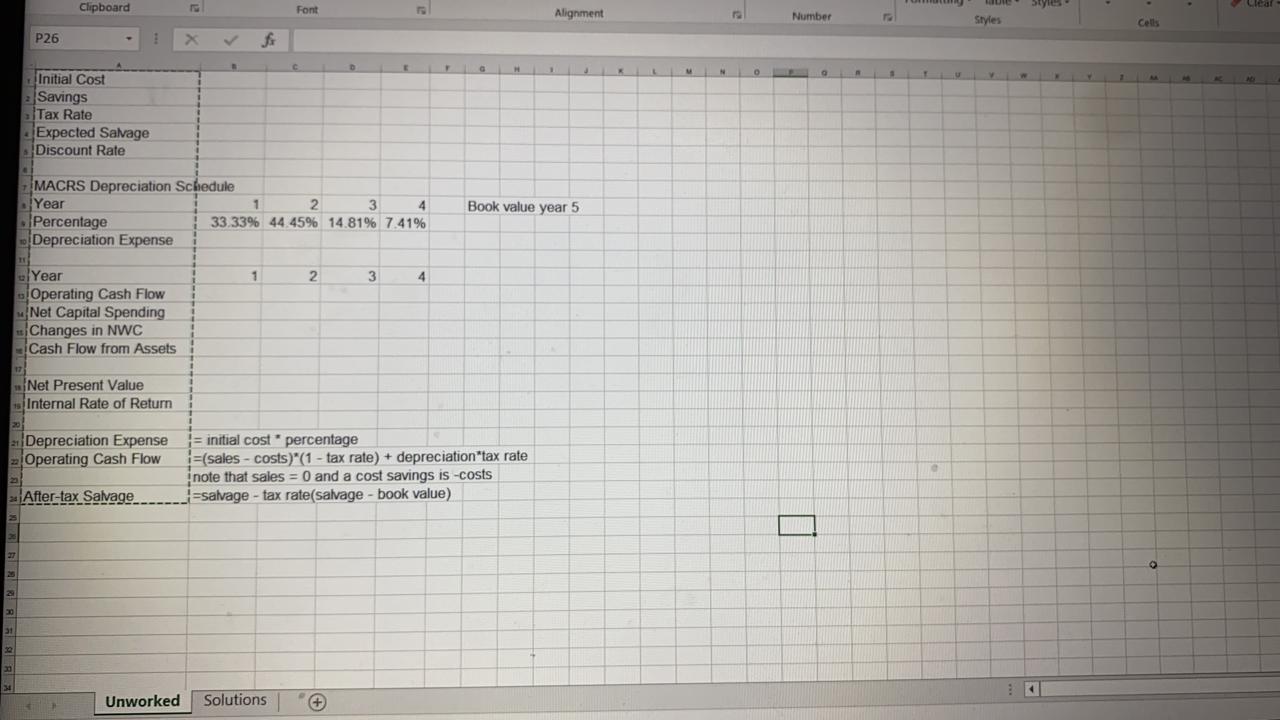

Copy - Paste BIU . B . S.A- $ - % Conditional Format as Cell & Fill - Format Painter Merge & Center Insert Delete Format Sort & Formatting . Table - Styles - Clear . Filter Clipboard Forit Alignment Number Styles Cells Editing H17 x v f Initial Cost 1,000,000 Savings 300,000 Tax Rate 409% Expected Salvage 50,000 Discount Rate 8% MACRS Depreciation Schedule Year 2 3 Book Value Percentage 33.33% 44 45% 14.81% 7.41% year 5 Depreciation Expense 333,300 444,500 148,100 74,100 0 Year 0 2 3 5 Operating Cash Flow 313,320 357,800 239,240 209,640 180,000 Net Capital Spending -1,000,000 30,000 Changes in NWC 0 Cash Flow from Assets -1,000,000 313,320 357,800 239,240 209,640 210,000 Net Present Value $83,797.50 Internal Rate of Return 11 45% Depreciation Expense = initial cost * percentage Operating Cash Flow (sales - costs)"(1 - tax rate) + depreciation tax rate note that sales = 0 and a cost savings is -costs Unworked Solutions Select destination and press ENTER or choose Paste Average: 77180.16615 Count: 54 Sum: 3010026.48Clipboard Font Alignment Number Styles Cells P26 X V Initial Cost Savings aTax Rate Expected Salvage Discount Rate MACRS Depreciation Schedule . Year 1 2 3 4 Book value year 5 . Percentage 33.33% 44 45% 14.81% 7.41% Depreciation Expense Year 2 3 Operating Cash Flow Net Capital Spending Changes in NWC Cash Flow from Assets "Net Present Value Internal Rate of Return iDepreciation Expense = initial cost * percentage Operating Cash Flow =(sales - costs)"(1 - tax rate) + depreciation"tax rate i note that sales = 0 and a cost savings is -costs After-tax Salvage =salvage - tax rate(salvage - book value) Unworked Solutions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts