Question: Copy Wrap Text GeneralPaste Merge & Center Conditional Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left

Copy

Wrap Text

GeneralPaste

Merge & Center

Conditional

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off?

Formatting

Office Update To keep uptodate with security updates, fixes, and improvements, choose Check for Updates.

A

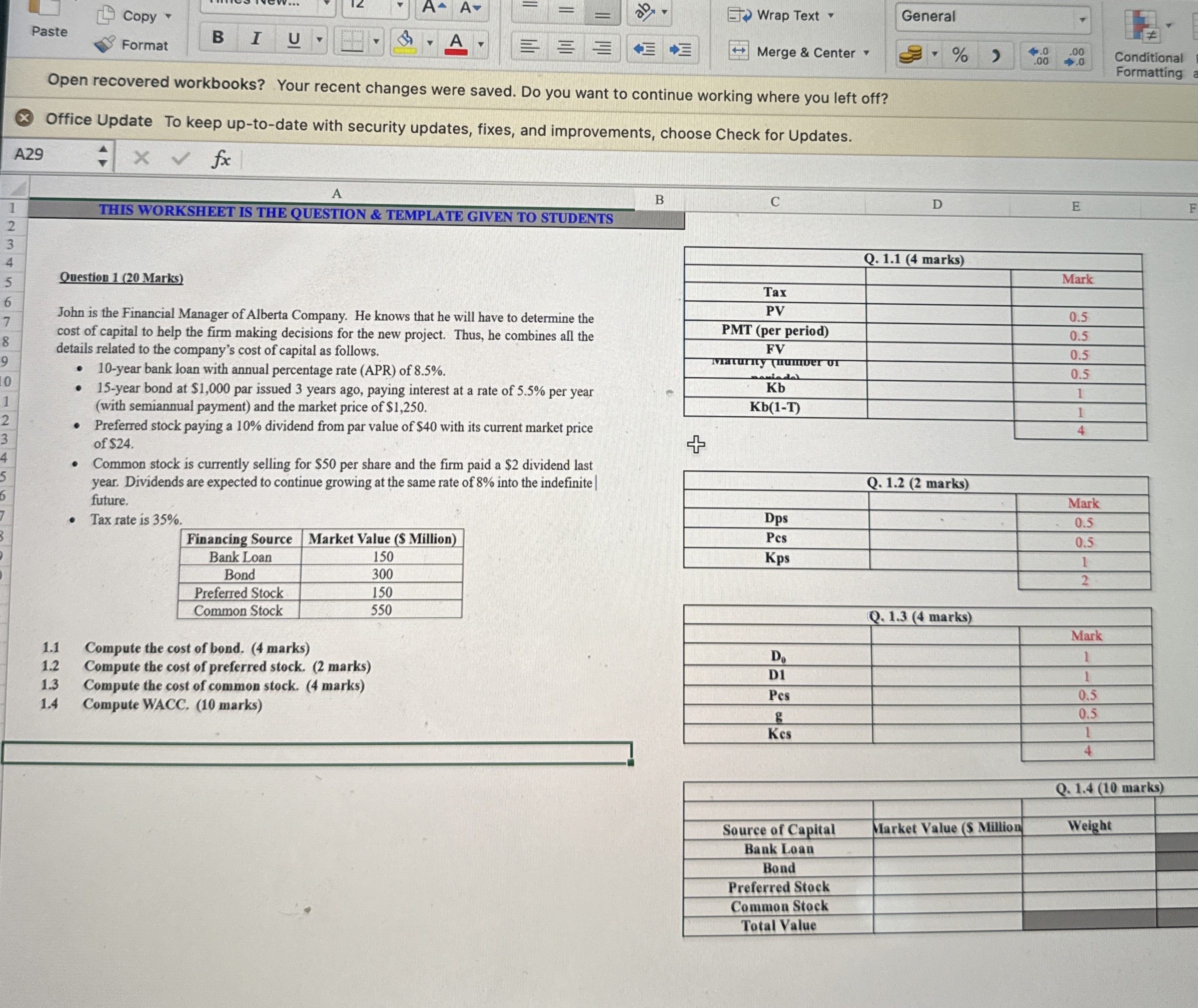

THIS WORKSHEET IS THE QUESTION & TEMPLATE GIVEN TO STUDENTS

Question Marks

John is the Financial Manager of Alberta Company. He knows that he will have to determine the cost of capital to help the firm making decisions for the new project. Thus, he combines all the details related to the company's cost of capital as follows.

year bank loan with annual percentage rate APR of

year bond at $ par issued years ago, paying interest at a rate of per year with semiannual payment and the market price of $

Preferred stock paying a dividend from par value of $ with its current market price of $

Common stock is currently selling for $ per share and the firm paid a $ dividend last year. Dividends are expected to continue growing at the same rate of into the indefinite future.

Tax rate is

tableFinancing Source,Market Value $ MillionBank Loan,BondPreferred Stock,Common Stock,

tableQ marksMarkDpsPcsKps

Compute the cost of bond. marks

Compute the cost of preferred stock. marks

Compute the cost of common stock. marks

Compute WACC. marks

tableQ marksMarkD DPcsgKcs

tableQ marksSource of Capital,Market Value S Million,Weight,Bank Loan,,,BondPreferred Stock,,,Common Stock,,,Total Value,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock