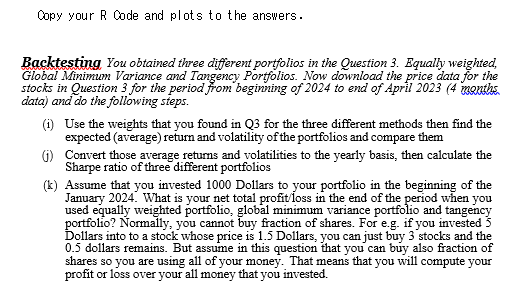

Question: Copy your R Code and plots to the answers. Backtesting You obtained three different portfolios in the Question 3 . Equally weighted, Global Minimum Variance

Copy your R Code and plots to the answers.

Backtesting You obtained three different portfolios in the Question Equally weighted,

Global Minimum Variance and Tangency Portfolios. Now download the price data for the

stocks in Question for the period from beginning of to end of April months

data and do the following steps.

i Use the weights that you found in Q for the three different methods then find the

expected average return and volatility of the portfolios and compare them

j Convert those average returns and volatilities to the yearly basis, then calculate the

Sharpe ratio of three different portfolios

k Assume that you invested Dollars to your portfolio in the beginning of the

January What is your net total profitloss in the end of the period when you

used equally weighted portfolio, global minimum variance portfolio and tangency

portfolio? Normally, you cannot buy fraction of shares. For eg if you invested

Dollars into to a stock whose price is Dollars, you can just buy stocks and the

dollars remains. But assume in this question that you can buy also fraction of

shares so you are using all of your money. That means that you will compute your

profit or loss over your all money that you invested.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock