Question: Copyright Total assets Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings (above) Total liabilities and equities Padre, Incorporated, buys 80 percent of

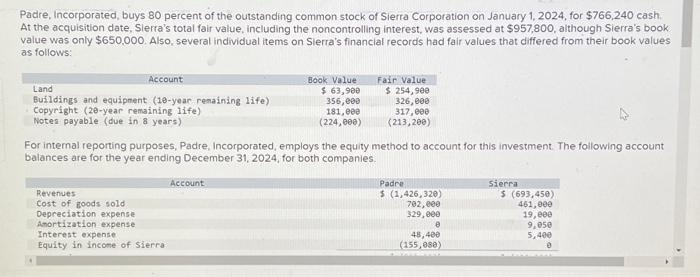

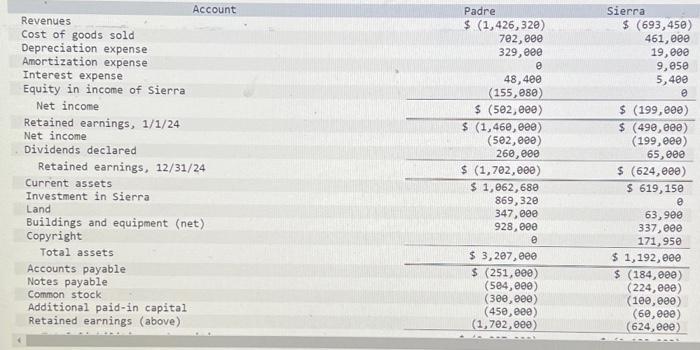

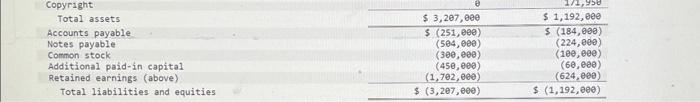

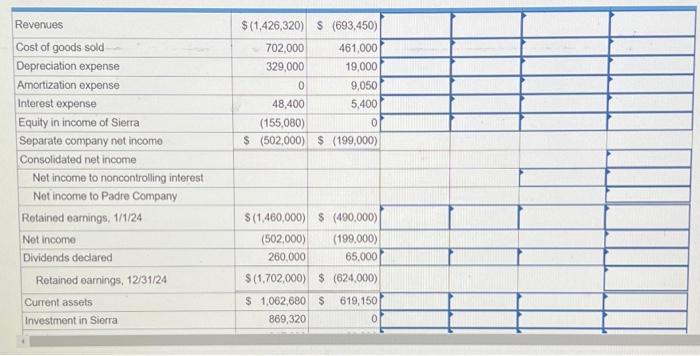

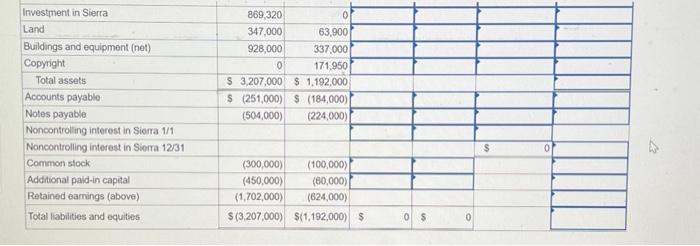

Copyright Total assets Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings (above) Total liabilities and equities Padre, Incorporated, buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2024, for $766,240 cash. At the acquisition date, Slerra's total fair value, including the noncontrolling interest, was assessed at $957,800, although Sierra's book value was only $650,000. Also, several individual items on Sierra's financlal records had fair values that differed from their book values as follows: For internal reporting purposes, Padre, Incorporated, employs the equity method to account for this investment. The following account balances are for the year ending December 31,2024 , for both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts