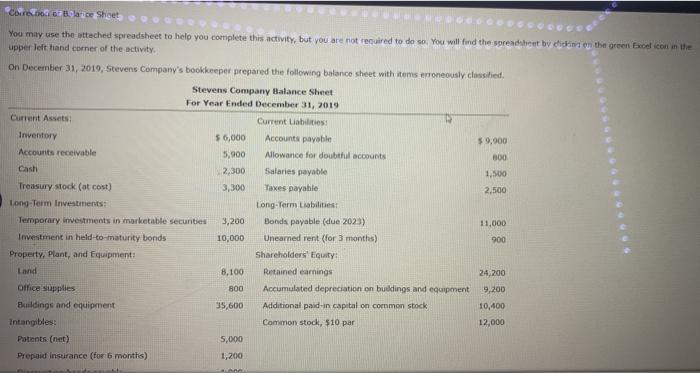

Question: Core Blarice Sheet You may use the attached spreadsheet to help you complete this activity, but you are not required to do so. You will

Core Blarice Sheet You may use the attached spreadsheet to help you complete this activity, but you are not required to do so. You will find the spreadsheet by didim on the green Excel icon in the upper left hand corner of the activity On December 31, 2019, Stevens Company's bookkeeper prepared the following balance sheet with items erroneously classified Stevens Company Balance Sheet For Year Ended December 31, 2019 Current Assets Current Liabilities: Inventory 56,000 Accounts payable $9.900 Accounts receivable 5.900 Allowance for doubthul accounts 000 Cash 2.300 Salaries payable 1,500 Treasury stock (at cost) 3,300 Taxes payable 2,500 Long-Term Investments: Long-Term Liabilities Temporary investments in marketable securities 3,200 Bonds payable (due 2023) 11,000 Investment in held-to-maturity bonds 10,000 Uneamed rent (for 3 months) 900 Property, plant, and Equipment Shareholders' Equity Land Retained earnings 24,200 Office Supplies 800 Accumulated depreciation on buildings and equipment 9,200 Buldings and equipment 35,600 Additional paid-in capital on common stock 10,400 Intangibles Common stock, $10 par 12,000 Patents (net) 5,000 Prepaid insurance (for 6 months) 1,200 8,100 . Core Blarice Sheet You may use the attached spreadsheet to help you complete this activity, but you are not required to do so. You will find the spreadsheet by didim on the green Excel icon in the upper left hand corner of the activity On December 31, 2019, Stevens Company's bookkeeper prepared the following balance sheet with items erroneously classified Stevens Company Balance Sheet For Year Ended December 31, 2019 Current Assets Current Liabilities: Inventory 56,000 Accounts payable $9.900 Accounts receivable 5.900 Allowance for doubthul accounts 000 Cash 2.300 Salaries payable 1,500 Treasury stock (at cost) 3,300 Taxes payable 2,500 Long-Term Investments: Long-Term Liabilities Temporary investments in marketable securities 3,200 Bonds payable (due 2023) 11,000 Investment in held-to-maturity bonds 10,000 Uneamed rent (for 3 months) 900 Property, plant, and Equipment Shareholders' Equity Land Retained earnings 24,200 Office Supplies 800 Accumulated depreciation on buildings and equipment 9,200 Buldings and equipment 35,600 Additional paid-in capital on common stock 10,400 Intangibles Common stock, $10 par 12,000 Patents (net) 5,000 Prepaid insurance (for 6 months) 1,200 8,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts