Question: Cornerstone Excercise 10.03 COMPLETE #4 ONLY Calculating Weighted Average Cost of Capital and Economic Value Added (EVA) Required: 1. Calculate the after-tax cost of each

Cornerstone Excercise 10.03 COMPLETE #4 ONLY

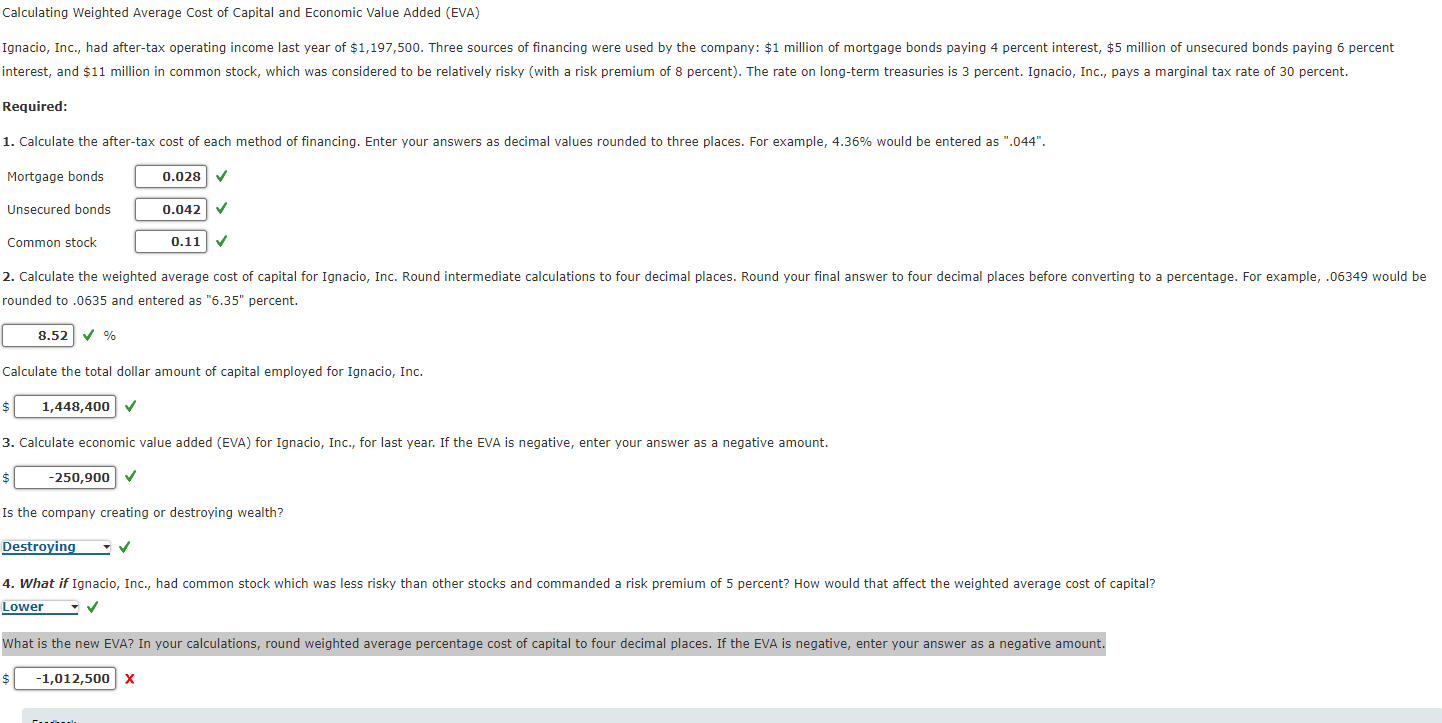

Calculating Weighted Average Cost of Capital and Economic Value Added (EVA) Required: 1. Calculate the after-tax cost of each method of financing. Enter your answers as decimal values rounded to three places. For example, 4.36% would be entered as ".044". Mortgage bonds Unsecured bonds Common stock rounded to .0635 and entered as " 6.35 " percent. % Calculate the total dollar amount of capital employed for Ignacio, Inc. 3. Calculate economic value added (EVA) for Ignacio, Inc., for last year. If the EVA is negative, enter your answer as a negative amount. Is the company creating or destroying wealth? 4. What if Ignacio, Inc., had common stock which was less risky than other stocks and commanded a risk premium of 5 percent? How would that affect the weighted average cost of capital? What is the new EVA? In your calculations, round weighted average percentage cost of capital to four decimal places. If the EVA is negative, enter your answer as a negative amount. X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts