Question: Cornerstone Exercise 13-1 Structuring an Outsourcing Problem Recently, Claude Manufacturing was approached by a firm that is offering to provide accounting and tax services for

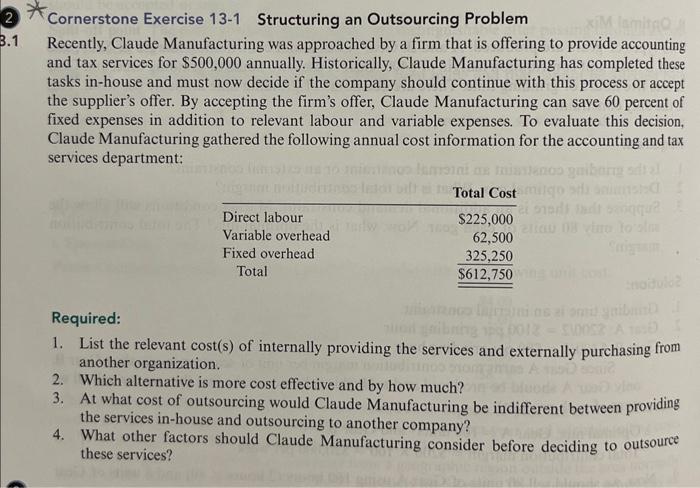

Cornerstone Exercise 13-1 Structuring an Outsourcing Problem Recently, Claude Manufacturing was approached by a firm that is offering to provide accounting and tax services for $500,000 annually. Historically, Claude Manufacturing has completed these tasks in-house and must now decide if the company should continue with this process or accept the supplier's offer. By accepting the firm's offer, Claude Manufacturing can save 60 percent of fixed expenses in addition to relevant labour and variable expenses. To evaluate this decision, Claude Manufacturing gathered the following annual cost information for the accounting and tax services department: Required: 1. List the relevant cost(s) of internally providing the services and externally purchasing from another organization. 2. Which alternative is more cost effective and by how much? 3. At what cost of outsourcing would Claude Manufacturing be indifferent between providing the services in-house and outsourcing to another company? 4. What other factors should Claude Manufacturing consider before deciding to outsource these services

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts