Question: Cornerstone Exercise 3-20 (Algorithmic) Deferred Expense Adjusting Entries Best Company had the following items that require adjustment at year end. a. Cash for equipment

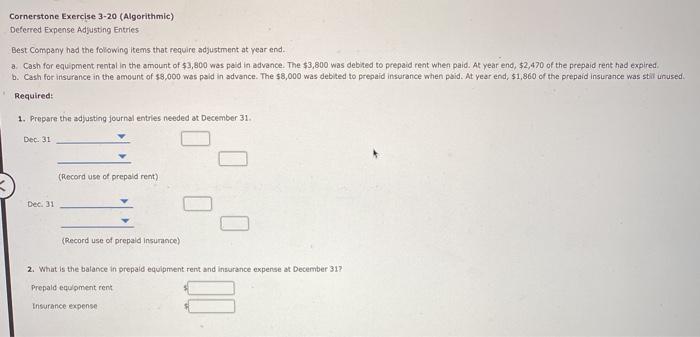

Cornerstone Exercise 3-20 (Algorithmic) Deferred Expense Adjusting Entries Best Company had the following items that require adjustment at year end. a. Cash for equipment rental in the amount of $3,800 was paid in advance. The $3,800 was debited to prepaid rent when paid. At year end, $2,470 of the prepaid rent had expired. b. Cash for insurance in the amount of $8,000 was paid in advance. The $8,000 was debited to prepaid insurance when paid. At year end, $1,860 of the prepaid insurance was still unused. Required: 1. Prepare the adjusting journal entries needed at December 31.1 Dec. 317 Dec. 31 (Record use of prepaid rent) (Record use of prepaid Insurance) 2. What is the balance in prepaid equipment rent and insurance expense at December 31? Prepaid equipment rent Insurance expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts