Question: Cornerstone Exercise 6-31 (Algorithmic) Inventory Costing Methods: Periodic LIFO (Appendix 6B) Bordeaux Company has the following information related to purchases and sales of one of

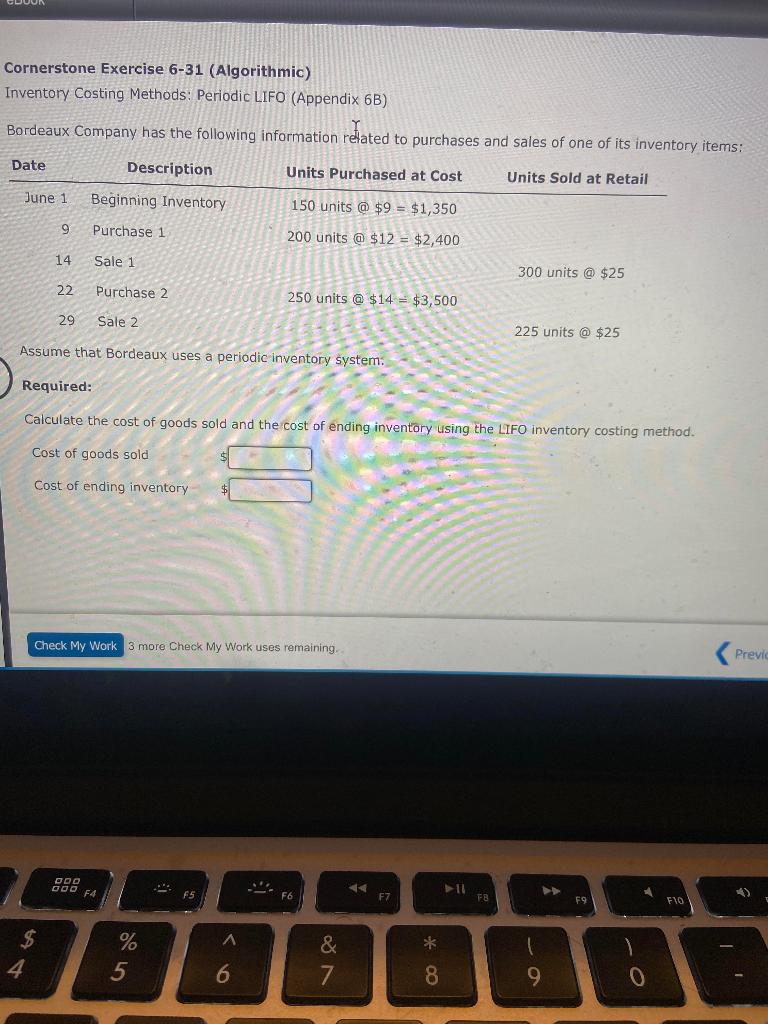

Cornerstone Exercise 6-31 (Algorithmic) Inventory Costing Methods: Periodic LIFO (Appendix 6B) Bordeaux Company has the following information related to purchases and sales of one of its inventory items: Date Description Units Purchased at Cost Units Sold at Retail June 1 Beginning Inventory 150 units @ $9 = $1,350 9 Purchase 1 200 units @ $12 = $2,400 14 Sale 1 300 units @ $25 22 Purchase 2 250 units @ $14 = $3,500 29 Sale 2 225 units @ $25 Assume that Bordeaux uses a periodic inventory system: Required: Calculate the cost of goods sold and the cost of ending inventory using the LIFO inventory costing method. Cost of goods sold Cost of ending inventory Check My Work 3 more Check My Work uses remaining. Previc JA 000 F4 FS F9 FO A * $ 4 % 5 & 7 a 6 8 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts