Question: Cornerstone Exercise 8-26 (Algorithmic) Payroll Taxes Hernandez Builders has a gross payroll for January amounting to $600,000. The following amounts have been withheld: Federal income

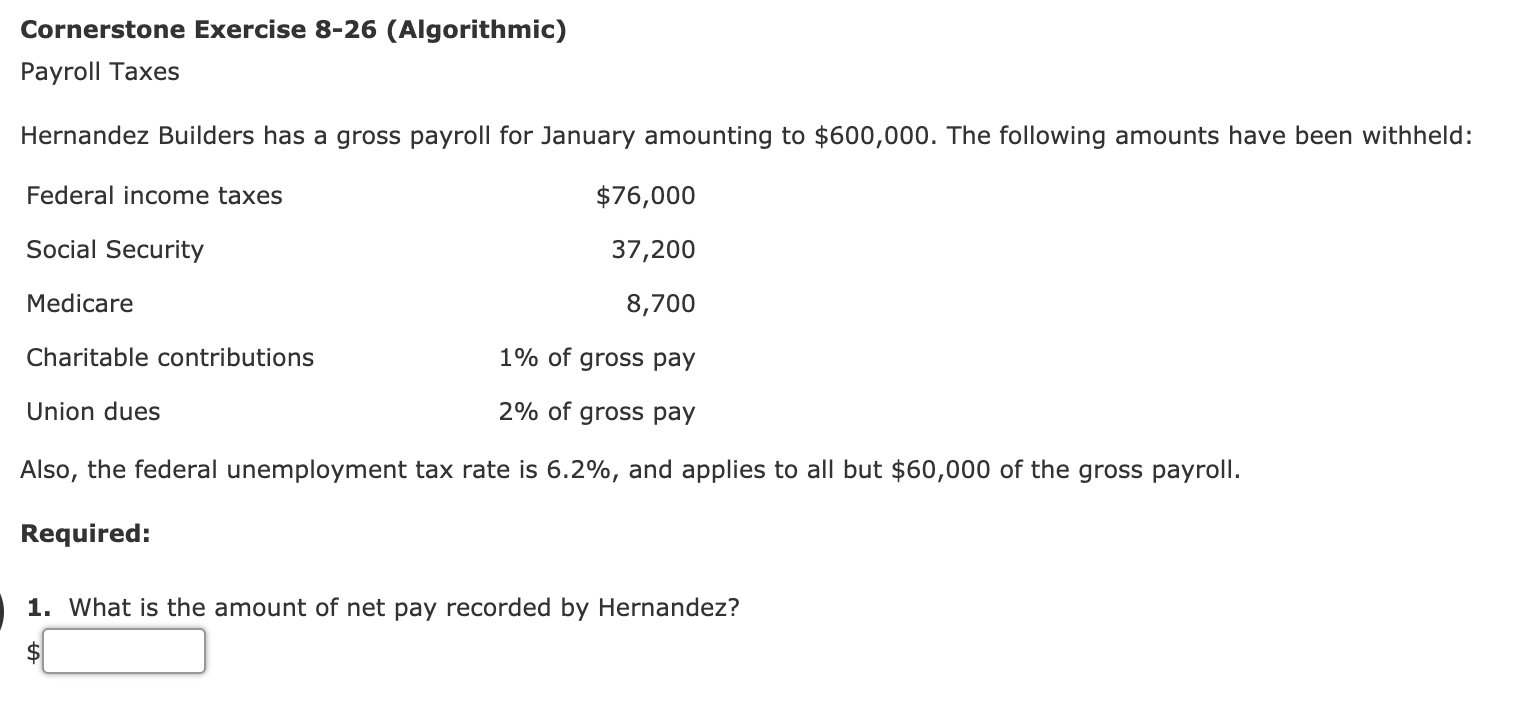

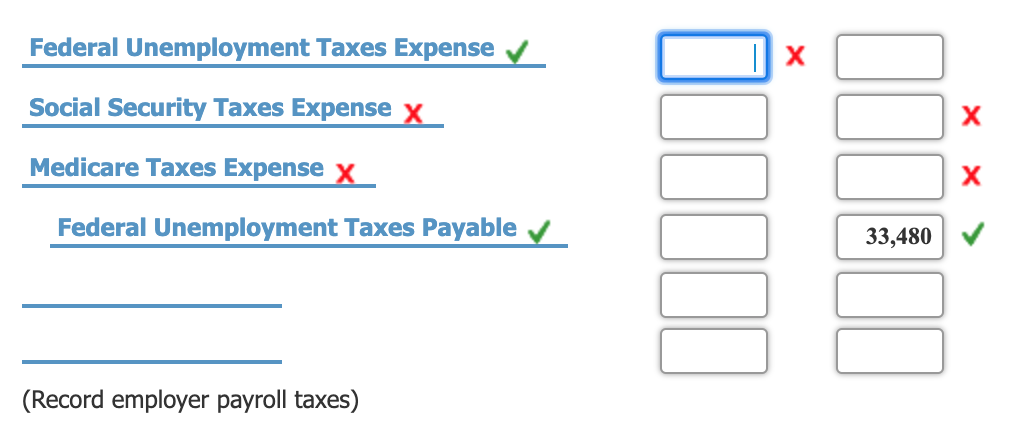

Cornerstone Exercise 8-26 (Algorithmic) Payroll Taxes Hernandez Builders has a gross payroll for January amounting to $600,000. The following amounts have been withheld: Federal income taxes $76,000 Social Security 37,200 Medicare 8,700 1% of gross pay Charitable contributions 2% of gross pay Union dues Also, the federal unemployment tax rate is 6.2%, and applies to all but $60,000 of the gross payroll. Required: 1. What is the amount of net pay recorded by Hernandez? Federal Unemployment Taxes Expense Social Security Taxes Expense x Medicare Taxes Expense x Federal Unemployment Taxes Payable 33,480 (Record employer payroll taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts