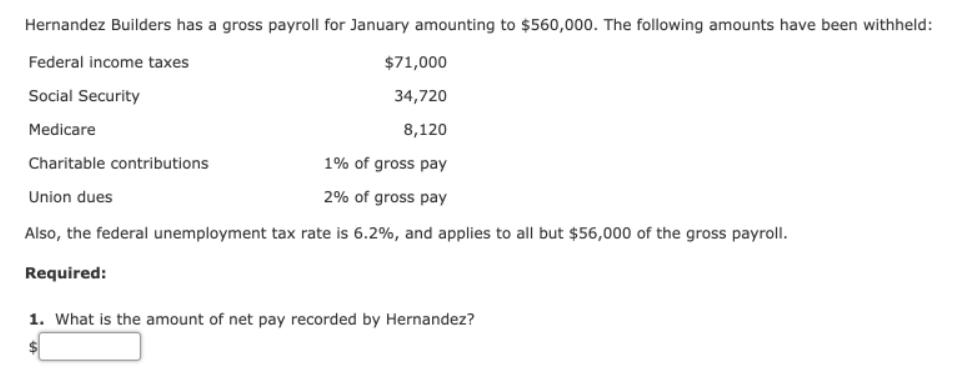

Question: Hernandez Builders has a gross payroll for January amounting to $560,000. The following amounts have been withheld: Federal income taxes $71,000 Social Security 34,720

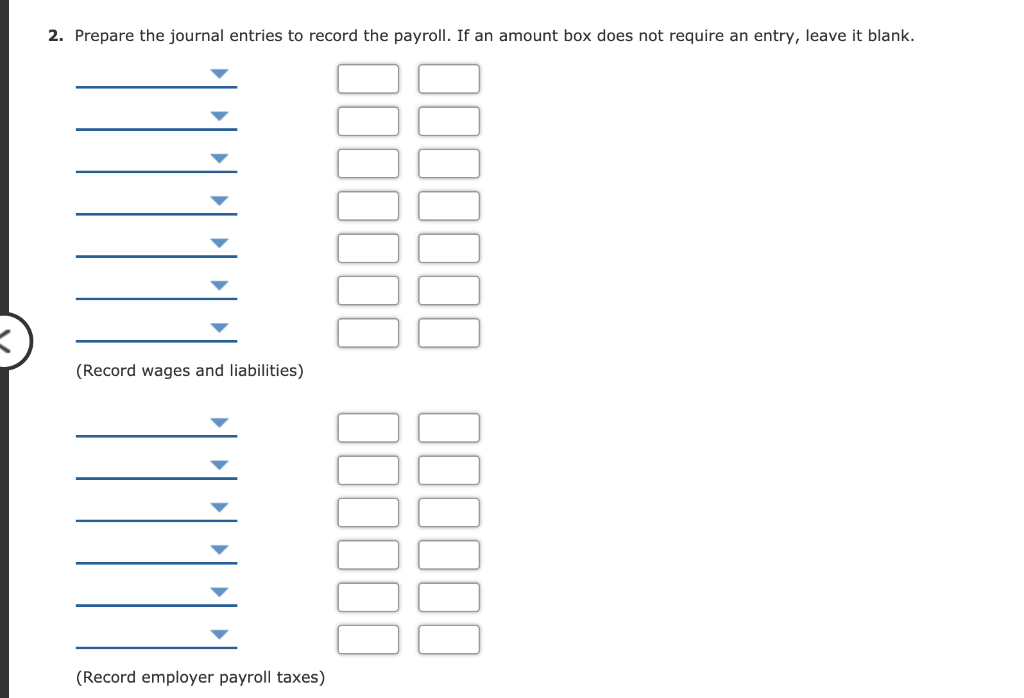

Hernandez Builders has a gross payroll for January amounting to $560,000. The following amounts have been withheld: Federal income taxes $71,000 Social Security 34,720 Medicare 8,120 Charitable contributions 1% of gross pay Union dues 2% of gross pay Also, the federal unemployment tax rate is 6.2%, and applies to all but $56,000 of the gross payroll. Required: 1. What is the amount of net pay recorded by Hernandez? 2. Prepare the journal entries to record the payroll. If an amount box does not require an entry, leave it blank. (Record employer payroll taxes)

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

1 Wages expense 560000 Less Deductions Federal Income taxes withholding payable 7... View full answer

Get step-by-step solutions from verified subject matter experts