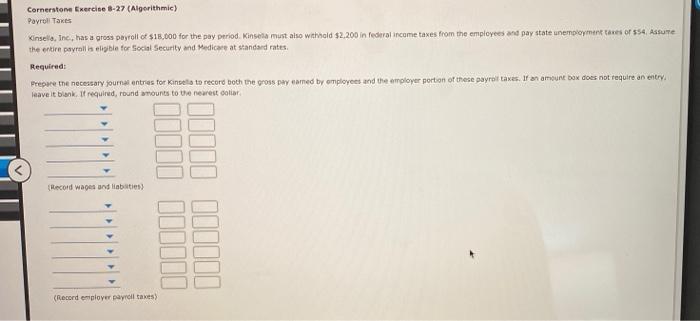

Question: Cornerstone Exercise 8-27 (Algorithmic) Payroll Taxes Kinsella, Inc, has a gross payroll of $18,000 for the pay period. Kinsel must also withhold $2.200 in federal

Cornerstone Exercise 8-27 (Algorithmic) Payroll Taxes Kinsella, Inc, has a gross payroll of $18,000 for the pay period. Kinsel must also withhold $2.200 in federal income taxes from the employees and pay state unemployment taxes or 554 Assume the entire payroll is eligible for Social Security and Medicare at standard rates Required: Prepare the necessary journal entries for kinse to record both the gross payeamed by employees and the employer portion of these payroll taxes. If an amount box does not require an entry leave it blank. It required, round mounts to the nearest collar Record Wages and liabutis) (Recordemloyer payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts