Question: Cornerstone Exercise 9-31 (Algorithmic) Bonds Issued at a Discount (Effective Interest) Sicily Corporation issued $750,000 in 9% bonds (payable on December 31, 2029) on January

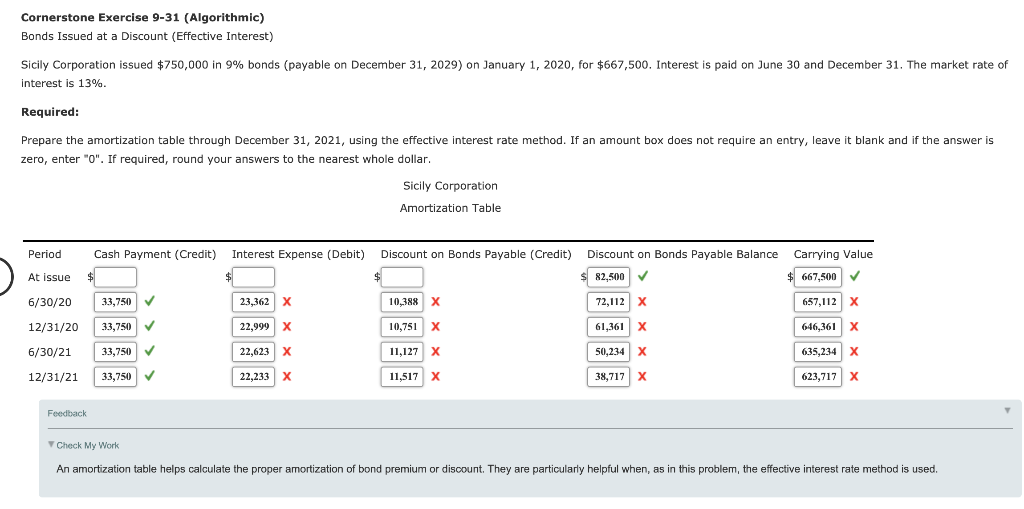

Cornerstone Exercise 9-31 (Algorithmic) Bonds Issued at a Discount (Effective Interest) Sicily Corporation issued $750,000 in 9% bonds (payable on December 31, 2029) on January 1, 2020, for $667,500. Interest is paid on June 30 and December 31. The market rate of interest is 13%. Required: Prepare the amortization table through December 31, 2021, using the effective interest rate method. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0". If required, round your answers to the nearest whole dollar. Sicily Corporation Amortization Table Period Cash Payment (Credit) Interest Expense (Debit) At issue 6/30/20 33,750 23,362 X Discount on Bonds Payable (Credit) Discount on Bonds Payable Balance Carrying Value 82,500 667,500 10,388 72,112 x 657,112 x 10,751 x 61,361 X 646,361 x 11,127 x 50,234 x 635,234 X 11,517 X 38,717 X 623,717 x 12/31/20 33,750 22,999 x 6/30/21 33,750 22,623 X 12/31/21 33,750 22,233 x Feedback Check My Work An amortization table helps calculate the proper amortization of bond premium or discount. They are particularly helpful when, as in this problem, the effective interest rate method is used. Cornerstone Exercise 9-31 (Algorithmic) Bonds Issued at a Discount (Effective Interest) Sicily Corporation issued $750,000 in 9% bonds (payable on December 31, 2029) on January 1, 2020, for $667,500. Interest is paid on June 30 and December 31. The market rate of interest is 13%. Required: Prepare the amortization table through December 31, 2021, using the effective interest rate method. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0". If required, round your answers to the nearest whole dollar. Sicily Corporation Amortization Table Period Cash Payment (Credit) Interest Expense (Debit) At issue 6/30/20 33,750 23,362 X Discount on Bonds Payable (Credit) Discount on Bonds Payable Balance Carrying Value 82,500 667,500 10,388 72,112 x 657,112 x 10,751 x 61,361 X 646,361 x 11,127 x 50,234 x 635,234 X 11,517 X 38,717 X 623,717 x 12/31/20 33,750 22,999 x 6/30/21 33,750 22,623 X 12/31/21 33,750 22,233 x Feedback Check My Work An amortization table helps calculate the proper amortization of bond premium or discount. They are particularly helpful when, as in this problem, the effective interest rate method is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts