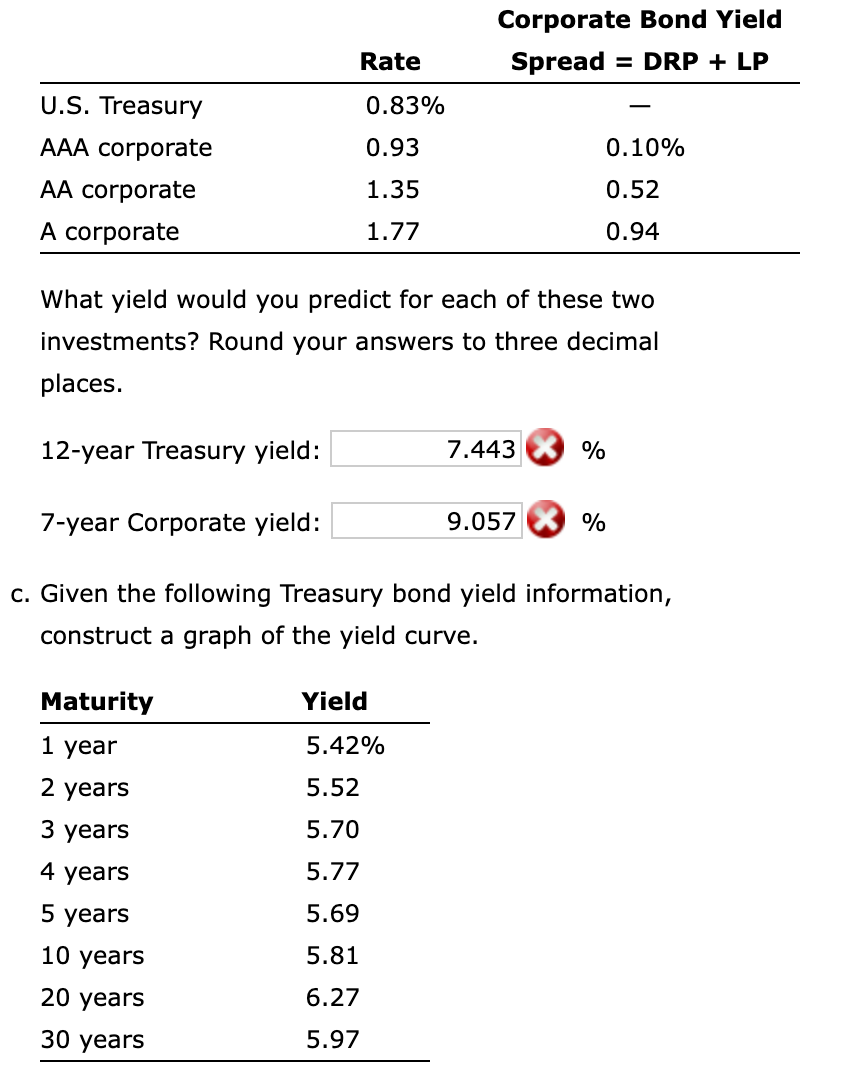

Question: Corporate Bond Yield Spread = DRP + LP Rate 0.83% 0.93 0.10% U.S. Treasury AAA corporate AA corporate A corporate 1.35 0.52 1.77 0.94 What

Corporate Bond Yield Spread = DRP + LP Rate 0.83% 0.93 0.10% U.S. Treasury AAA corporate AA corporate A corporate 1.35 0.52 1.77 0.94 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 7.443 % 7-year Corporate yield: 9.057 % C. Given the following Treasury bond yield information, construct a graph of the yield curve. Yield Maturity 1 year 5.42% 2 years 5.52 3 years 5.70 4 years 5.77 5 years 5.69 10 years 5.81 20 years 6.27 30 years 5.97 Corporate Bond Yield Spread = DRP + LP Rate 0.83% 0.93 0.10% U.S. Treasury AAA corporate AA corporate A corporate 1.35 0.52 1.77 0.94 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 7.443 % 7-year Corporate yield: 9.057 % C. Given the following Treasury bond yield information, construct a graph of the yield curve. Yield Maturity 1 year 5.42% 2 years 5.52 3 years 5.70 4 years 5.77 5 years 5.69 10 years 5.81 20 years 6.27 30 years 5.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts