Question: Corporate Taxation And Management Decisions 773 Assignment Problems W Assignment Problem Fifteen - 7 (Shareholder Loans) Borsa Ltd. is a Canadian controlled private corporation with

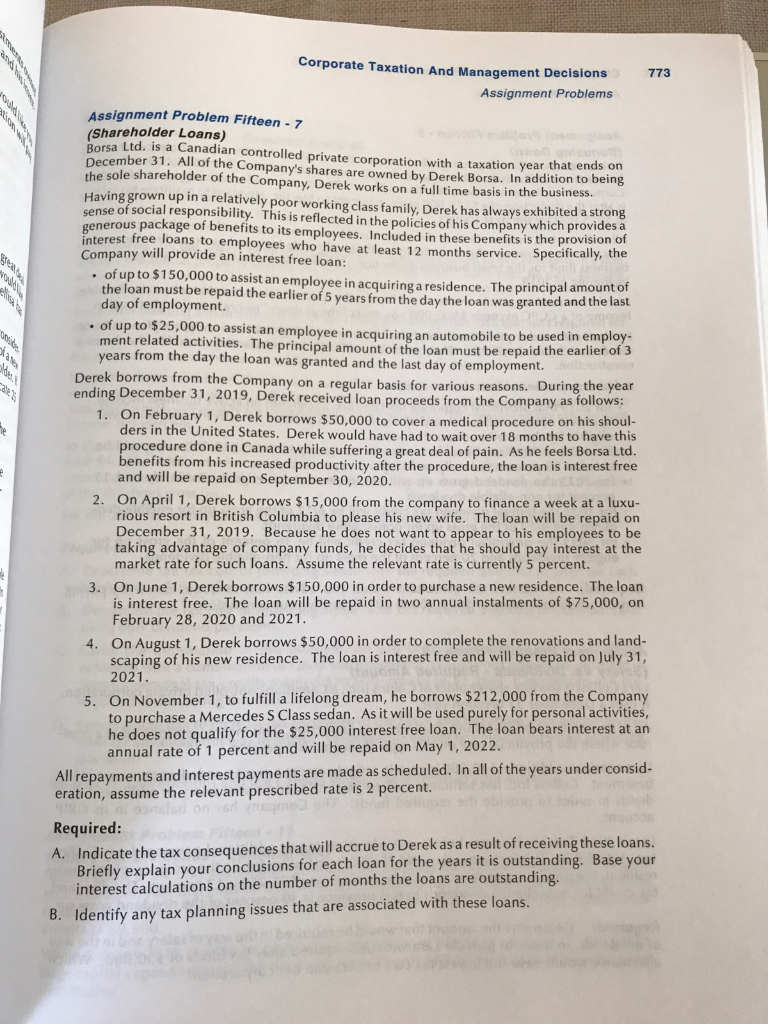

Corporate Taxation And Management Decisions 773 Assignment Problems W Assignment Problem Fifteen - 7 (Shareholder Loans) Borsa Ltd. is a Canadian controlled private corporation with a taxation year that ends on December 31. All of the Company's shares are owned by Derek Borsa. In addition to being the sole shareholder of the Company, Derek works on a full time basis in the business. Having grown up in a relatively poor working class family, Derek has always exhibited a strong sense of social responsibility. This is reflected in the policies of his Company which provides a generous package of benefits to its employees. Included in these benefits is the provision of interest free loans to employees who have at least 12 months service. Specifically, the Company will provide an interest free loan: of up to $150,000 to assist an employee in acquiring a residence. The principal amount of the loan must be repaid the earlier of 5 years from the day the loan was granted and the last day of employment. of up to $25,000 to assist an employee in acquiring an automobile to be used in employ; ment related activities. The principal amount of the loan must be repaid the earlier of 3 years from the day the loan was granted and the last day of employment. Derek borrows from the Company on a regular basis for various reasons. During the year ending December 31, 2019, Derek received loan proceeds from the Company as follows: 1. On February 1, Derek borrows $50,000 to cover a medical procedure on his shoul- ders in the United States. Derek would have had to wait over 18 months to have this procedure done in Canada while suffering a great deal of pain. As he feels Borsa Ltd. benefits from his increased productivity after the procedure, the loan is interest free and will be repaid on September 30, 2020. 2. On April 1, Derek borrows $15,000 from the company to finance a week at a luxu- rious resort in British Columbia to please his new wife. The loan will be repaid on December 31, 2019. Because he does not want to appear to his employees to be taking advantage of company funds, he decides that he should pay interest at the market rate for such loans. Assume the relevant rate is currently 5 percent. 3. On June 1, Derek borrows $150,000 in order to purchase a new residence. The loan is interest free. The loan will be repaid in two annual instalments of $75,000, on February 28, 2020 and 2021. 4. On August 1, Derek borrows $50,000 in order to complete the renovations and land- scaping of his new residence. The loan is interest free and will be repaid on July 31, 2021. 5. On November 1, to fulfill a lifelong dream, he borrows $212,000 from the Company to purchase a Mercedes S Class sedan. As it will be used purely for personal activities, he does not qualify for the $25,000 interest free loan. The loan bears interest at an annual rate of 1 percent and will be repaid on May 1, 2022. All repayments and interest payments are made as scheduled. In all of the years under consid- eration, assume the relevant prescribed rate is 2 percent Required: A. Indicate the tax consequences that will accrue to Derek as a result of receiving these loans. Briefly explain your conclusions for each loan for the years it is outstanding. Base your interest calculations on the number of months the loans are outstanding. B. Identify any tax planning issues that are associated with these loans. an is merest." Corporate Taxation And Management Decisions 773 Assignment Problems W Assignment Problem Fifteen - 7 (Shareholder Loans) Borsa Ltd. is a Canadian controlled private corporation with a taxation year that ends on December 31. All of the Company's shares are owned by Derek Borsa. In addition to being the sole shareholder of the Company, Derek works on a full time basis in the business. Having grown up in a relatively poor working class family, Derek has always exhibited a strong sense of social responsibility. This is reflected in the policies of his Company which provides a generous package of benefits to its employees. Included in these benefits is the provision of interest free loans to employees who have at least 12 months service. Specifically, the Company will provide an interest free loan: of up to $150,000 to assist an employee in acquiring a residence. The principal amount of the loan must be repaid the earlier of 5 years from the day the loan was granted and the last day of employment. of up to $25,000 to assist an employee in acquiring an automobile to be used in employ; ment related activities. The principal amount of the loan must be repaid the earlier of 3 years from the day the loan was granted and the last day of employment. Derek borrows from the Company on a regular basis for various reasons. During the year ending December 31, 2019, Derek received loan proceeds from the Company as follows: 1. On February 1, Derek borrows $50,000 to cover a medical procedure on his shoul- ders in the United States. Derek would have had to wait over 18 months to have this procedure done in Canada while suffering a great deal of pain. As he feels Borsa Ltd. benefits from his increased productivity after the procedure, the loan is interest free and will be repaid on September 30, 2020. 2. On April 1, Derek borrows $15,000 from the company to finance a week at a luxu- rious resort in British Columbia to please his new wife. The loan will be repaid on December 31, 2019. Because he does not want to appear to his employees to be taking advantage of company funds, he decides that he should pay interest at the market rate for such loans. Assume the relevant rate is currently 5 percent. 3. On June 1, Derek borrows $150,000 in order to purchase a new residence. The loan is interest free. The loan will be repaid in two annual instalments of $75,000, on February 28, 2020 and 2021. 4. On August 1, Derek borrows $50,000 in order to complete the renovations and land- scaping of his new residence. The loan is interest free and will be repaid on July 31, 2021. 5. On November 1, to fulfill a lifelong dream, he borrows $212,000 from the Company to purchase a Mercedes S Class sedan. As it will be used purely for personal activities, he does not qualify for the $25,000 interest free loan. The loan bears interest at an annual rate of 1 percent and will be repaid on May 1, 2022. All repayments and interest payments are made as scheduled. In all of the years under consid- eration, assume the relevant prescribed rate is 2 percent Required: A. Indicate the tax consequences that will accrue to Derek as a result of receiving these loans. Briefly explain your conclusions for each loan for the years it is outstanding. Base your interest calculations on the number of months the loans are outstanding. B. Identify any tax planning issues that are associated with these loans. an is merest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts