Question: Corporations can raise capital using either debt (and must pay interest) or equity (and are expected to pay dividends). However, the interest expense is

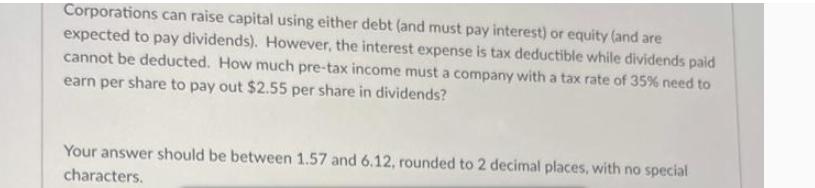

Corporations can raise capital using either debt (and must pay interest) or equity (and are expected to pay dividends). However, the interest expense is tax deductible while dividends paid cannot be deducted. How much pre-tax income must a company with a tax rate of 35% need to earn per share to pay out $2.55 per share in dividends? Your answer should be between 1.57 and 6.12, rounded to 2 decimal places, with no special characters.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

To find out how much pretax income per share the company needs to earn we can us... View full answer

Get step-by-step solutions from verified subject matter experts