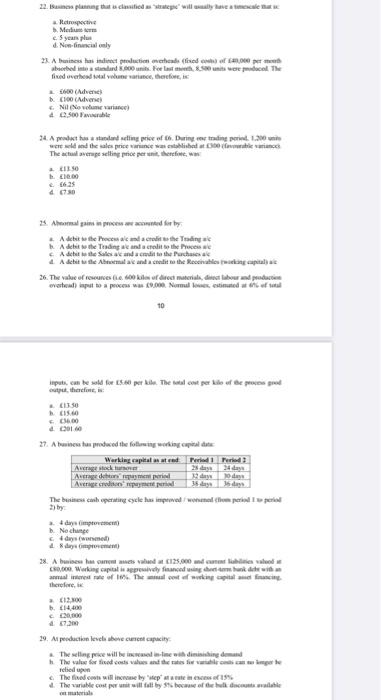

Question: corrct answer only Kerethe Medium yeans plus Netically 23. A bela e peltincha (fined of belastendard. Forse Sons were docel fived overhead alone ande, herefore,

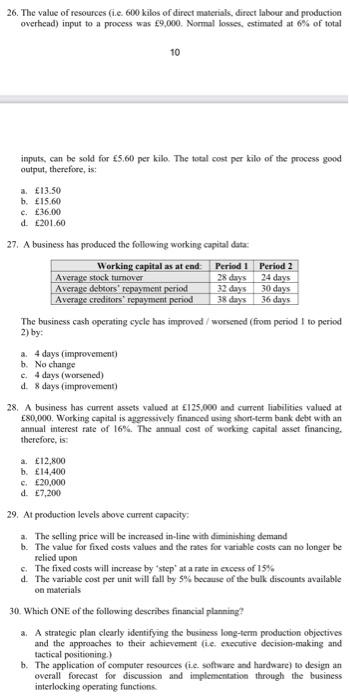

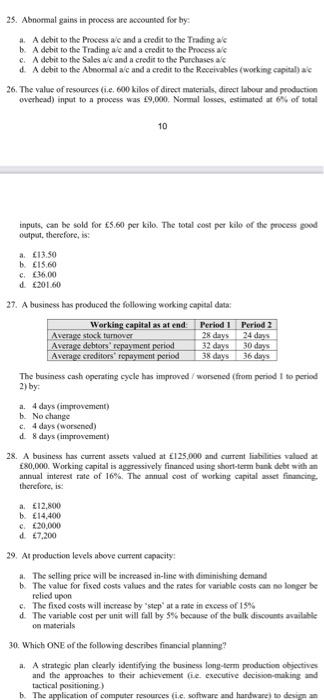

Kerethe Medium yeans plus Netically 23. A bela e peltincha (fined of belastendard. Forse Sons were docel fived overhead alone ande, herefore, hen 100 Ne volume varice) 4.500 Ft 24. Apraksts started in price of 6. During our trading print. 1.200 wered and the sale price ince was established once The activerage selling peperonto, ISO . 10.00 4070 2. Amalgam pewned for by Adesit e Pecual and actolits the Trading Adebito e Trading and credit to the Presse Adebate Sales and act to the choses 4. A debut the bemala and a credit to the Rectal 26. The value of nes tokie of direct materials de labor and poductie vestea pot to picem . Nemalestined of 10 pus can be for sale. The welcome per kilo of de prospeed 00 d00 27. A beadwed the form working capital de Warkingapa Period Period Average lockor 23.4 Average de termen price The business cash operating cycle has impewa well perill peris Nechung days wie immen 28. A his has the 125.000 de la vald 0.00. Working capital sy faced wing hos hunde i amaliere le The not fucking paling therefore, 12.300 . 14.400 09.30 29. Apeduction levels ove curent capacity The linge will be remei diminishing The value for the codes and relied upon The final cos will now by eple of 13% 1. The wie costruit will fall by of the hollowable 26. The value of resources (.e. 600 kilos of direct materials, direct labour and production overhead) input to a process was 9,000. Normal losses, estimated at 6% of total 10 inputs, can be sold for 5.60 per kilo. The total cost per kilo of the process good output, therefore, is: a 13.50 b. 15.00 c. 36.00 d. 201.60 27. A business has produced the following working capital data: Working capital as at end Period 1 Period 2 Average stock turnover 28 days 24 days Average debtors' repayment period 32 days 30 days Average creditors' repayment period 38 days 36 days The business cash operating cycle has improved / worsened (from period I to period 2) by a. 4 days (improvement) b. No change c. 4 days (worsened) d. 8 days (improvement) 28. A business has current assets valued at 125,000 and current liabilities valued at 80,000. Working capital is aggressively financed using short-term bank debt with an annual interest rate of 16%. The annual cost of working capital asset financing therefore, is: a. E12,800 b. 14,400 c. 20,000 d. 7,200 29. At production levels above current capacity a. The selling price will be increased in-line with diminishing demand b. The value for fixed costs values and the rates for variable costs can no longer be c. The fixed costs will increase by step at a rate in excess of 15% d. The variable cost per unit will fall by S% because of the bulk discounts available on materials 30. Which ONE of the following describes financial planning? a. A strategic plan clearly identifying the business long-term production objectives and the approaches to their achievement (ie. executive decision-making and tactical positioning.) b. The application of computer resources (.e. software and hardware) to design an overall forecast for discussion and implementation through the business interlocking operating functions 25. Abnormal gains in process are accounted for by: #. A debit to the Processale and a credit to the Trading ac A debit to the Trading ale and a credit to the Process ac c. A debit to the Sales ac and a credit to the Purchases al A debit to the Abnormal alc and a credit to the Receivables (working capital) ale 26. The value of resources (ie. 600 kilos of direct materials, direct labour and production overhead) input to a process was 9,000. Normal losses, estimuted at 6% of total 10 inputs, can be sold for 5.60 per kilo. The total cost per kilo of the process pood output, therefore, is: a. (13.50 b. 15.60 c. (36.00 201.60 27. A business has produced the following working capital data: Working capital as at end: Period 1 Period 2 Average stock turnover 28 days 24 days Average debtors repayment period 32 days 30 days Average creditors' repayment period 38 days 36 days The business cash operating cycle has improved / worsened (from period I to period 2) by: a. 4 days (improvement) b. No change c. 4 days (worsened) d. 8 days (improvement) 28. A business has current assets valued at 125.000 and current liabilities valued at 80,000. Working capital is aggressively financed using short-term bank debt with an annual interest rate of 16%. The annual cost of working capital asset financing therefore, is: a 12.800 b. 14,400 c. 20,000 d 17,200 29. At production levels above current capacity: # The selling price will be increased in-line with diminishing demand The value for fixed costs values and the rates for variable costs can no longer be relied upon c. The fixed costs will increase by step at a rate in excess of 15% d. The variable cost per unit will fall by 5% because of the bulk discounts available on materials 30. Which ONE of the following describes financial planning? 4. A strategic plan clearly identifying the business long-term production objectives and the approaches to their achievement (e. executive decision-making and tactical positioning b. The application of computer resources (ic, software and hardware) to design an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts