Question: Correct and Complete: Requirement 2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2020. Begin by selecting the formula

Correct and Complete:

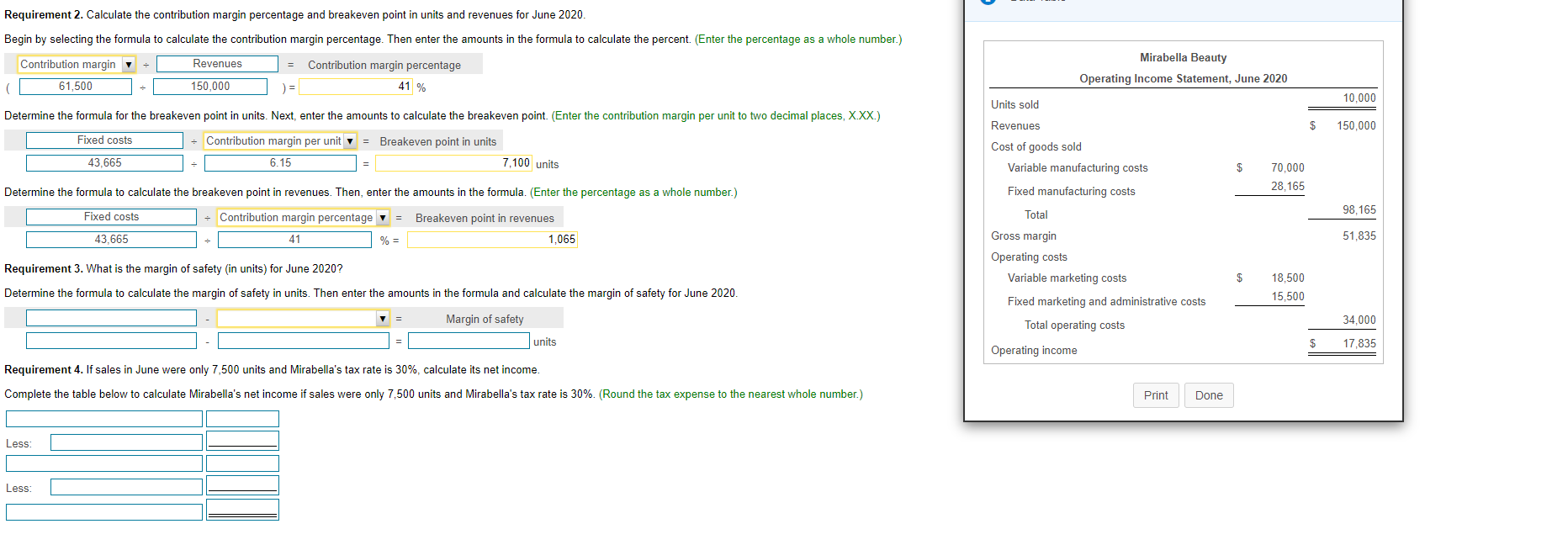

Requirement 2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2020. Begin by selecting the formula to calculate the contribution margin percentage. Then enter the amounts in the formula to calculate the percent. (Enter the percentage as a whole number.) Contribution margin Revenues Contribution margin percentage 61,500 150,000 ) = 41 % Mirabella Beauty Operating Income Statement, June 2020 Units sold 10,000 Determine the formula for the breakeven point in units. Next, enter the amounts to calculate the breakeven point. (Enter the contribution margin per unit to two decimal places, X.XX.) $ 150,000 Fixed costs = Breakeven point in units Contribution margin per unity 6.15 43,665 7,100 units $ 70,000 28,165 Determine the formula to calculate the breakeven point in revenues. Then, enter the amounts in the formula. (Enter the percentage as a whole number.) Fixed costs 98,165 - Contribution margin percentage = Breakeven point in revenues 1,065 43,665 41 % = Revenues Cost of goods sold Variable manufacturing costs Fixed manufacturing costs Total Gross margin Operating costs Variable marketing costs Fixed marketing and administrative costs Total operating costs Operating income 51,835 Requirement 3. What is the margin of safety (in units) for June 2020? Determine the formula to calculate the margin of safety in units. Then enter the amounts in the formula and calculate the margin of safety for June 2020 $ 18,500 15,500 Margin of safety 34.000 units $ 17,835 Requirement 4. If sales in June were only 7,500 units and Mirabella's tax rate is 30%, calculate its net income. Complete the table below to calculate Mirabella's net income if sales were only 7,500 units and Mirabella's tax rate is 30%. (Round the tax expense to the nearest whole number.) Print Done Less: Less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts